The Situation

You’re sitting outside a café in Milan enjoying the perfect espresso watching the people rush in all directions. You landed the night before and are ready for a much needed vacation. You signal for the check and let the waiter know that you’d like to pay with your credit card, because you’ve read my post 4 Tips for Spending Money Better While Abroad. He inserts your card into the machine and turns to you with a question “Would you like to pay in euros or dollars?” It takes a second for his Italian to register, then your mind begins to race— “I’m in Europe. Should I pay in euros? My bank account is dollars…What should I do?!?”

Should You Pay in Local or Home Currency?

The question of currency, local or home, is becoming a common decision for travelers abroad. It’s due to the growing popularity of a service called dynamic currency conversion in which a merchant offers to convert the transaction into your home currency. Sounds like a wonderful innovation to make life easier for travelers right? Way to go banks!

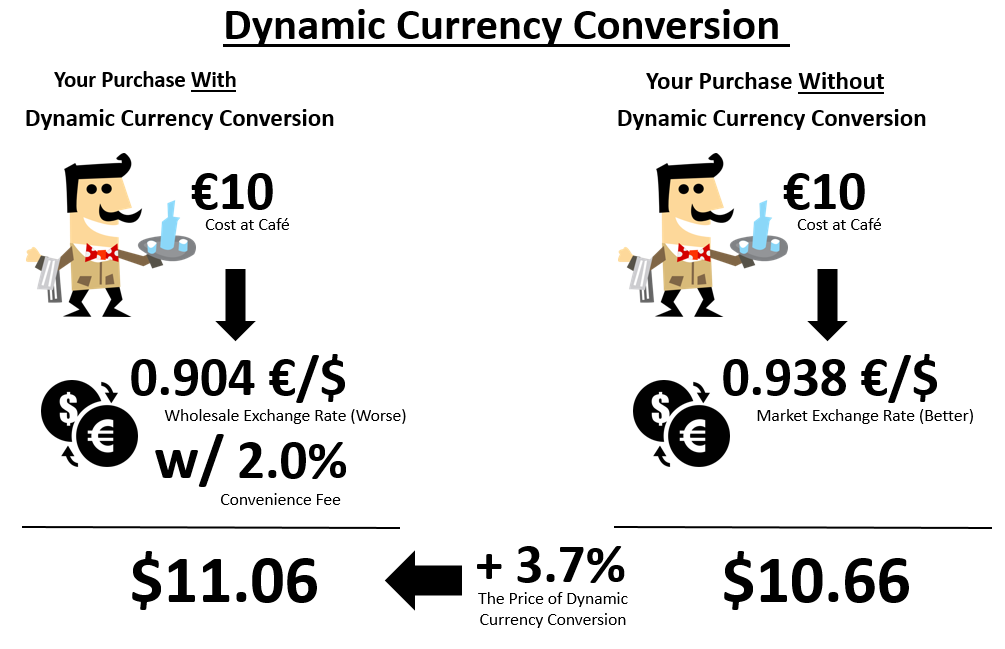

Wrong. Although having the option to pay in dollars sounds like a good thing, it’s generally worse for you as the consumers (and actually benefits the merchant). When you have the option, you should always pay in local currency. Why is this the case? Let’s look at two transactions:

If you choose to use dynamic currency conversion (and pay in dollars), you’ll be hit with a less favorable exchange rate, as well as, a convenience fee ranging from 2-3.5%. Does this sound like something that’s good for travelers?

Dynamic Currency Conversion and Foreign Transaction Fees

Many believe that dynamic currency conversion is good for consumers because it saves them on foreign transaction fees. Unfortunately, this is a misconception. Foreign transaction fees have nothing to do with the payment currency, they are a fee for using your credit card outside of the national system. If you elect dynamic currency conversion, your bank may still charge a foreign transaction fee and you could easily be paying 6-7% above the market exchange rate when all the fees are included. Foreign transaction fees or not, dynamic currency conversion adds to the cost of your transaction.

What to do About it?

The most unfortunate aspect of dynamic currency conversion is if you’re using a credit card, it’s not so easy to avoid. You can’t call up Visa and MasterCard and tell them you’d like to opt out of the service. Additionally, many merchants are either misinformed, unaware, or malicious. I know all about the additional costs of dynamic currency conversion, but still oftentimes find that I’ve “agreed” to pay in dollars. So how do you stop yourself from paying an additional 3-5% on all of your credit card purchases abroad?

1. Make Your Preference Known

I’ve gotten in the habit of proactively saying “quiero pagar en euros, por favor” (I want to pay in euros, please) when I hand a merchant my card. For the most part they agree, or respond by saying that there is no other option (as not all merchants offer dynamic currency conversion). However, some merchants still choose dollars. This may be because some credit card readers switch to English when an American credit card is inserted or because they believe they’re doing me a favor. Unfortunately, there is no way to know and since the merchant gets a cut of the conversion fees, some may be doing it to increase revenue and take advantage of travelers.

2. Take the Machine

Hand-held credit card readers were created to protect consumers. They allow you to maintain sight of your credit card and review the transaction amount to prevent thief or fraud. Once a merchant or waiter enters the bill amount and inserts your credit card, it’s your right to take the machine. This allows you to review the amount entered and click the accept button (which is why machines switch to English). Now, with the introduction dynamic currency conversion, you should hold the machine a bit longer to answer a second question: “Would you like to pay in local or foreign currency?” I’ve become a lot more forward with taking the machine when paying by credit card, so that I can confirm the amount and ensure that I’m paying in euros. This can be hard at first for Americans, as we are not accustomed to taking the credit card machine, but it’s normal in other cultures.

3. Fight the Charges

So, what do you do if the merchant chooses dollars for you? First, try to assume they did so by accident or with the belief that it is in your benefit to pay in your home currency. For small transactions, you’ll probably be upset for a moment and then get over it. If the bill is for $10 or $20, it’s not worth the trouble of arguing in another language over a dollar.

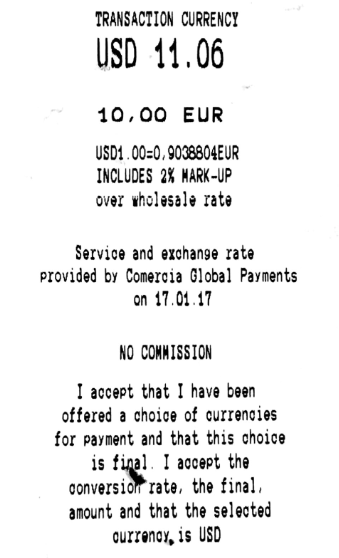

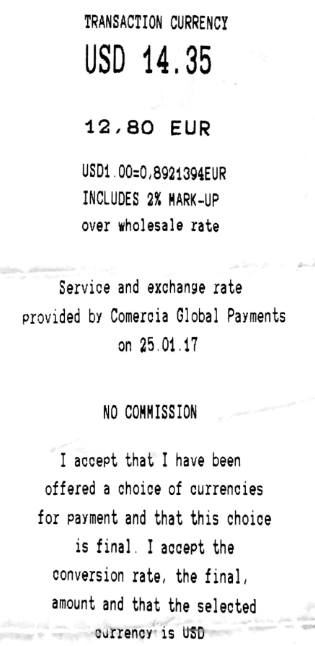

If it’s a much larger transaction, you may want to dispute it. To do this you should refuse to sign the receipt, as it is an acknowledgement of your agreement to pay in dollars (see the language on the receipts above). Then you should ask them to rerun the transaction in the local currency. Yes, you’ll end up with two charges on your credit card statement, but you can easily follow the normal process for disputing a duplicate transaction. Simply notify your credit card issuer that you requested to pay in local currency, a mistake was made, and the first transaction should not be paid. Most companies make this a relatively easy and painless process.

If All Else Fails, Pay in Cash

In my 4 Tips for Spending Money While Abroad I wrote “use a credit card whenever possible”. Well if you find that you are unintentionally being charged in dollars, don’t like the idea of constantly reminding merchants, or want to avoid causing a scene after a nice meal on your honeymoon, then pay cash. The benefits of using a credit card (security and rewards points) quickly become outweighed by the fees and poor exchange rate associated with dynamic currency conversion.

Airbnb Pro-Tip

If you have ever booked an Airbnb in another country, you’ve likely been hurt by dynamic currency conversion and may not have known it. I sure have! Airbnb’s website states:

“If you’re paying in a currency different from the default currency of the country where the listing or experience are located, we also charge a 3% conversion fee on your total cost.”

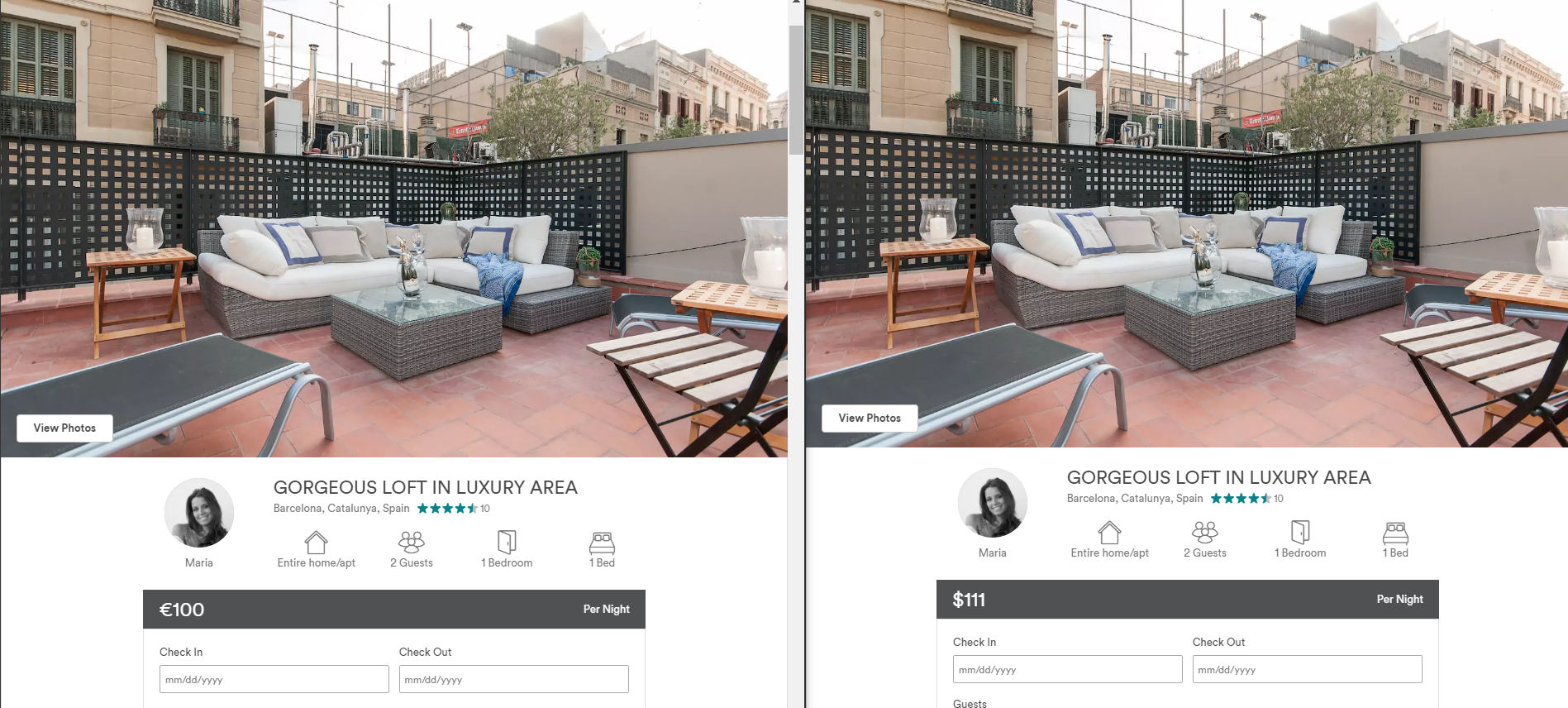

Without saying it directly, they are referring to dynamic currency conversion which means: crappy exchange rate and a fee. Come on Airbnb, I thought we were friends! In the example below, my booking costs increased 3.7% (over the market exchange rate at the time) when I viewed them in dollars instead of euros.

Airbnb makes it easy for you to view prices in the local currency (scroll to the bottom and you’ll find a dropdown box), but they don’t make it easy to pay in that currency. When you proceed to book Airbnb “conveniently” converts the price to your home currency. If you want to actually pay in the local currency (and save money by avoiding dynamic currency conversion), you must go to your profile and change the home country that’s listed on your account.

Bottom Line

Dynamic currency conversion is one more aspect of traveling where consumers need to be diligent. While it is marketed as a convenience, it’s almost universally bad for consumers to pay in their home currency. Now you know the additional costs, but that is only half the battle! Review your bill, communicate your preference, and take control of credit card machines. When in doubt, pay cash and simply enjoy your time abroad.