In late 2007, Eric Violette and his band smashed onto the music scene with hits that got stuck in the head of every man, woman, and child for what seemed like an eternity. Altogether they had nine musical masterpieces that covered a wide spectrum of topics—pirates, roller coasters, used cars, and bicycles. Unfortunately, the band broke up in February of 2010 and by the time they got back together for a reunion tour in 2012 the world had lost interest. If you are like me this was your first real experience with credit scores. You guessed it, the band I’m referring to is from FreeCreditReport.com.

The funny thing about these commercials is that there are real lessons in each of them. Eric experiences all the major consequences of poor credit and failing to monitor his score. He can’t get a job, or a house, and even has difficulty getting a cell phone plan. If you don’t want to end up like Eric (renting an apartment by the week and riding your bike to work at a renaissance fair), it’s important to know the components of your credit score and how you can improve each one.

The 6 Components of Your Credit Score

There are six components of your credit score, each with a different level of impact. If you’d like to follow along with this post and review your credit score as we discuss, I suggest setting up an account at www.creditkarma.com. It’s free to use, doesn’t spam you, and has a very user-friendly interface.

1. Credit Card Utilization – High Impact

Credit card utilization is the total balance of all of your credit cards divided by the sum of their limits. If all your cards are maxed out, your utilization is 100%. If you have all zero balances, your utilization is 0%. A utilization of less than 10% is generally thought of as excellent, but 0% is not. Lenders like to see that you are able to use credit cards responsibly. This doesn’t mean you need to carry a balance from month to month! A rate above zero can be achieved by using your card regularly. As you pay off your bill in full each month, you’ll have already accumulated new charges for the following month.

How to Improve Your Credit Card Utilization

If your credit card utilization rate is poor (above 30%), don’t worry, this is one of the easiest and quickest components to improve. There are two things at play: utilized credit and available credit.

Utilized Credit: Carrying a balance from month to month is how most people end up with utilization ratios above 30%. If this is you, take steps to pay down your debt and stop using credit cards until you have control over your spending! (Check out my post 11 Rules for Using Credit Cards Wisely to learn more.)

Available Credit: If you’re not carrying a balance from month to month and your utilization is still above 30%, your total available credit is the issue. Ideally, you want your total available credit to be at least ten times your monthly spending. (That will keep your utilization safely under 10%.) In this situation, you have two options: request an increase on existing cards or apply for new ones. Requesting an increase is the best way to go because it’s easier, faster, and won’t negatively affect your credit (more on credit inquiries later). All you have to do is call or log on to your card’s website and ask for the increase. If you’ve had the card for a while and made all your payments on time, you shouldn’t have a problem obtaining an increase.

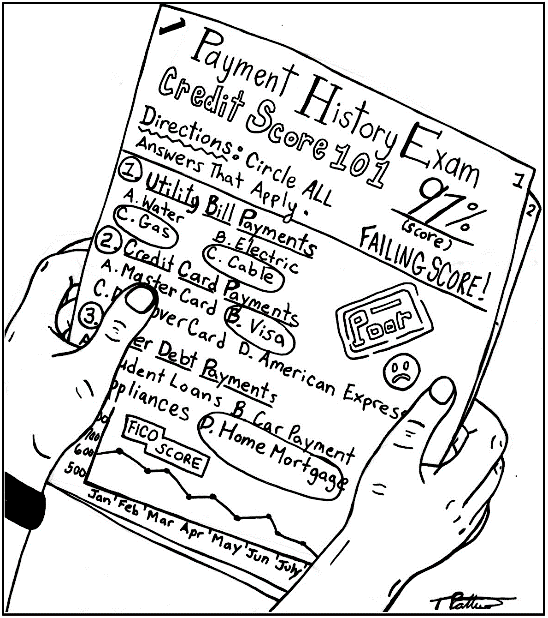

2. Payment History – High Impact

Payment history is the percentage of debt payments (e.g., credit cards, student loans, car loans, mortgage payments) you’ve made on time. Even missing one or two can hurt your score significantly.

The margin for error on payment history is really low: 100% is excellent, 99% is good, and 97% is poor. This means it can take some time to recover from just a few missed payments. For example, if you made 100 payments and just 3 of them were late, you’ve got a poor score of 97%. You’ll have to make another 200 on-time payments before your score moves back up to 99%. That could take a long time!

tpattersonart.com

tpattersonart.com

How to Improve Your Payment History

First, set your bills to autopay so that you never miss another! From there, there’s really only one option for improving: make more payments. If you already have a few credit cards that you’re not using, this will be fairly easy. Each month, charge at least one small purchase on each card you have. (No, I’m not telling you to go out and by things you wouldn’t already be purchasing!) Even small purchases will generate bills, which will generate payments, which are now set to autopay. Then just sit back and watch your payment history improve over time.

3. Negative or Derogatory Marks– High Impact

The third and final high impact factor of your credit score is negative or derogatory marks. It’s like every bad thing you did in school that’s been chronicled on your permanent record and the employee at AT&T reviews it before giving you a cell phone.

Ok, obviously it’s a bit different than school. But this section of your credit report lists things such as bankruptcies, foreclosures, collections, tax liens, and civil judgments. Any one of these misfortunes can have a hugely negative impact on your score and will stay with you for up to seven years. One mark will drop you to “fair”, and a second will take you down to “poor”.

The most common mark is surprisingly easy to encounter: having an account sent to collections. A simple oversight such as not having your mail forwarded or failing to update autopay can quickly escalate into a poor credit score.

How to Improve Your Derogatory Marks

As bleak as it sounds, there is no way to improve this component except to wait it out. Therefore, you should take every step possible to avoid them by following my 11 Rules for Using Credit Cards Wisely.

4. Length of Credit History – Medium Impact

This component is calculated as the average age of your open credit cards. My oldest card is nine years old. I proudly opened it to save 15% on acid wash jeans from Old Navy. I only used the card once (and eventually ditched acid wash jeans), but I will never close it. The long history of that card provides significant benefits to my overall average.

How to Improve Your Length of Credit History Score

The best step you can take to improve this part of your score is to keep old cards open. So long as they don’t have an annual fee, old cards can be beneficial because they increase your history and utilization scores. Don’t run out and close your newer cards just to increase your average history. Closing cards could have a detrimental effect overall by reducing your total available credit and hurting your utilization score.

5. Total Number of Accounts – Low Impact

Total number of accounts is unique in that it is influenced by both open and closed accounts. Here, more is better, with more than 20 accounts considered “excellent”. This is a low impact component of your credit score, so don’t go out and open new accounts simply to improve this portion. Let it happen naturally over time.

6. Credit Inquiries – Low Impact

The final component is credit inquires, which gets a lot of media attention. “Don’t check your credit score, because that could hurt your credit!” or “Don’t apply for too many credit cards in a short period, because that could hurt your credit!” While the media is not wrong, it is not always painting the full picture. Importantly, there are two types of inquiries and only one is (slightly) detrimental.

Soft Credit Inquiry: You will not be penalized for activities like checking your credit score, undergoing background checks, or receiving pre-approval for a credit card.

Hard Credit Inquiry: Applying for a credit card, mortgage, or loan will negatively affect your credit score, but only slightly (low impact component) and only for a short period of time.

How to Get A Higher Credit Score

Don’t concern yourself too much with the last three factors, as they have a medium to low impact on your credit score. Of course they are not to be ignored, but are not nearly as significant as the high impact components of credit utilization, payment history, and derogatory marks. Even if your scores for length of credit history, total number of accounts, and credit inquiries are “poor” or “fair”, it’s still possible to have an overall credit score of “excellent”.

The Secret to Rapid Credit Score Improvement

Rarely is there an easy fix to financial problems, but luckily if you are trying to quickly build your credit there’s a solution. First, you’ll need a trusted friend, spouse, or relative that has a card with a long history of on-time payments and a low utilization ratio. This person can’t transfer their credit score to you, but can essentially lend it for an extended or indefinite period of time by adding you as an authorized user.

When you are added as an authorized user on another person’s card, sometimes (it depends on the card issuer) the card will be reported on your credit report. If you’re added to the right card, it can do wonders for increasing your average credit history, credit card optimization, and payment history. This can quickly drive up your credit score and give you a foundation to secure credit cards and loans of your own.

Conclusion

Your credit score is so important! Employers, car dealers, lenders, rental agencies, landlords, cell phone companies, and a whole host of other entities may check your credit score. If you need to improve it, focus your energy on the three high impact components: credit utilization, payment history, and derogatory marks. If time is of the essence, find someone with whom you have strong mutual trust and become an authorized user on their card(s). When all else fails, start a rock band and write songs about your credit troubles. History has shown that to be a lucrative career choice.

Are you interested in getting one-on-one advice to improve your credit score? Click here to schedule a FREE 30 minute call with David, a Certified Financial Planner (CFP®) professional and Certified Public Accountant (CPA), and get answers to all of your money questions.