What is Foreign Account Tax Compliance Act (FATCA) reporting?

The Foreign Account Tax Compliance Act (FATCA) requires certain U.S. taxpayers who hold specified foreign financial assets (defined below) with an aggregate value above certain thresholds (which are as low as $50,000) to report information on Form 8938. This is in addition to reporting requirements such as FinCen Form 114, Report of Foreign Bank and Financial Accounts (FBAR).

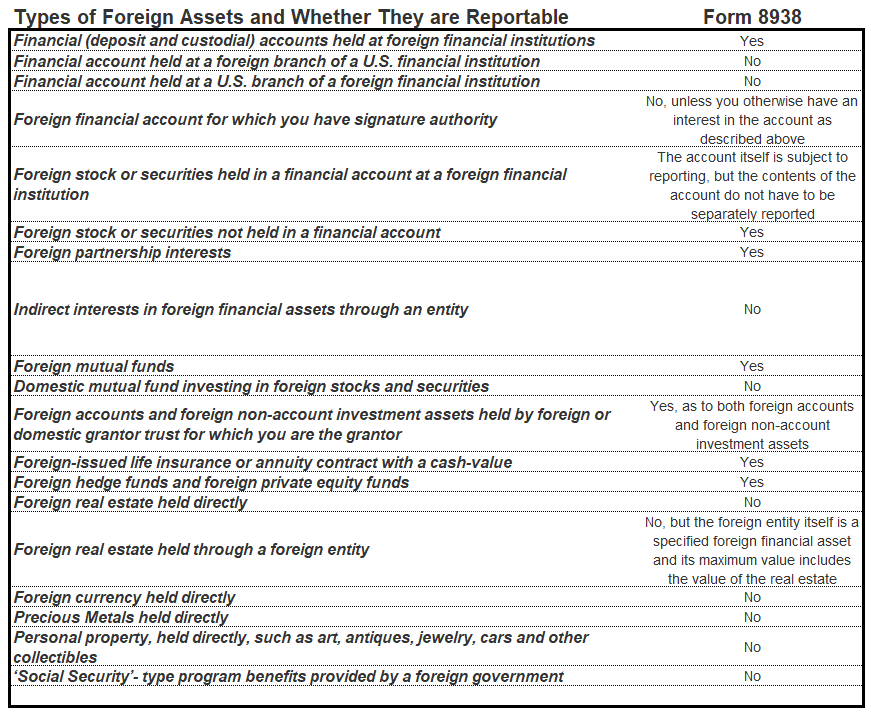

What are specified foreign financial assets?

Specified foreign financial assets are foreign financial accounts and assets held for investment. The IRS provides an easy-to-use table to determine which assets are reportable:

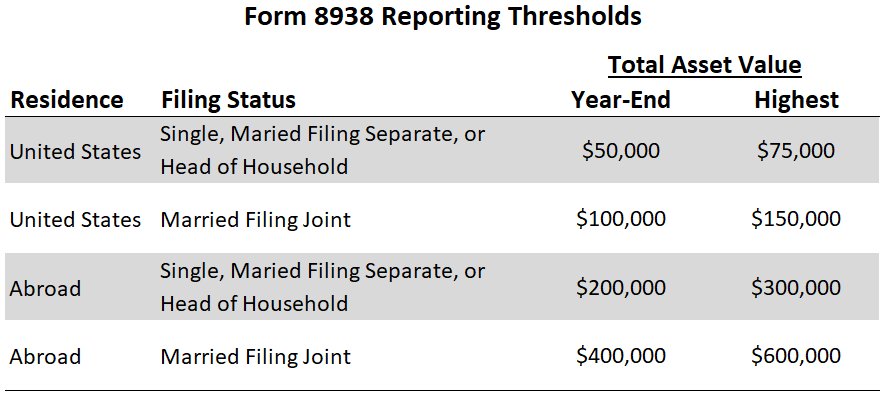

What are the Form 8938 reporting thresholds?

Form 8938 reporting thresholds depend upon two factors: whether you live inside (or outside) the United States and your filing status (single or joint).

As you can see from the chart above, each set of factors has two thresholds that your specified foreign financial assets can exceed to independently trigger a Form 8938 filing requirement: the total year-end value and the highest value during the year.

How do I determine if I crossed the threshold?

Both the year-end and highest balance thresholds are based on the aggregate value of your specified foreign financial assets converted to U.S. dollars. To determine if you have crossed the threshold:

- Determine the highest and December 31st value of each of your specified foreign financial assets in their local currency.

- Convert each highest and December 31st value to U.S. dollars using the official U.S. Treasury exchange rate at the end of the year. (Which can be found here: Official Historical Exchange Rates)

- Add all of the highest balances and December 31st values together and compare them to the thresholds.

Let’s do an example: You are a single U.S. citizen and have been living in the UK for the last 10 years. Therefore your filing thresholds are a $200,000 year-end balance or a highest balance of $300,000.

You have a UK bank account and have been making regular contributions to a UK retirement account. Your retirement account experiences steady growth and its year-end balance of £120,000 is also its highest balance. You normally never have more than £10,000 in your bank account, but you sold your flat in London this year and moved to a new one. After the sale, £100,000 were deposited into your account for two days before you made a down payment on your new home. By the end of the year, your UK bank balance was back to its normal level of £10,000.

To determine if you have crossed the filing threshold you would aggregate the highest and year-end balance of each account then convert those totals to U.S. dollars (we’ll use 1.4 dollars to a pound as the exchange rate).

Year-End: £120,000 + £10,000 = £130,000 X 1.4 = $182,000 (below the threshold).

Highest: £120,000 + £110,000 = £230,000 X 1.4 = $322,000 (above the threshold).

In the above example, you have a Form 8938 filing required based on $322,000, even though your specified foreign financial assets only exceeded the threshold for a matter of days.

Should I try to stay below the reporting threshold?

If you’re able to stay below the Form 8938 thresholds, preparing your tax return will be easier, but it won’t affect the amount of tax you pay.

Remember, Form 8938 is an information-only form. If you’re doing a lot of transfers and find yourself with a Form 8938 filing requirement when you normally wouldn’t, don’t sweat it. Your account values will look a little bigger and you may appear a little richer, but this won’t cause you to pay a penalty or owe additional taxes.

Of course, if your foreign assets pay interest, dividends, or produce income, you may owe taxes on that income. That information must be reported on your income tax return, just as it would if it was a U.S.-based financial asset.

If I file Form 8938, do I still need to file an FBAR?

Yes! Form 8938 does not replace your requirement to file an annual FBAR Form 114. If you pass the threshold to file Form 8938, it is highly probable that you’re also required to file an FBAR. The assets and information included on each form vary slightly, but both are subject to separate filing requirements and should be reviewed and prepared independently.

Why should I care about Form 8938 filing?

The IRS takes the reporting of foreign financial assets very seriously:

Failure to report foreign financial assets on Form 8938 may result in a penalty of $10,000 (and a penalty up to $50,000 for continued failure after IRS notification). Further, underpayments of tax attributable to non-disclosed foreign financial assets will be subject to an additional substantial understatement penalty of 40 percent.

What should I do if I didn’t file properly in the past?

Contact a qualified tax professional to discuss amending your prior-year returns.

Do you have questions about FATCA Foreign Asset Reporting? Leave Them in the Comments Below!

Resources

IRS Summary – FATCA Reporting for U.S. Taxpayers

Form 8938: Statement of Specified Foreign Financial Assets

Form 8938: Instructions