What is the Tax Cuts and Jobs Act?

In December 2017 the Tax Cuts and Jobs Act was passed and signed into law. It is widely cited as the largest reform to the tax code since the Tax Reform Act of 1986, signed under President Ronald Reagan. The Tax Cuts and Jobs Act:

- Dramatically reduces the corporate tax rate.

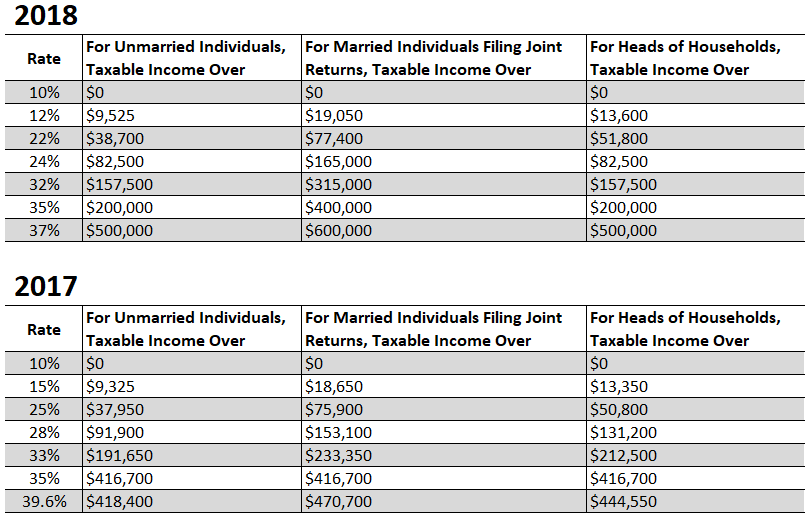

- Lowers many of the individual tax brackets.

- Eliminates or limits many itemized deductions.

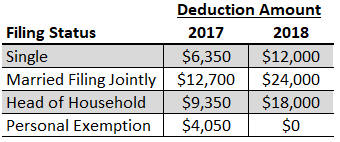

- Nearly doubles the standard deductions.

- Eliminates personal exemptions.

- Doubles the estate tax exemption.

- Removes the individual mandate of the Affordable Care Act.

- And so much more!

What Do I Need to Know About the Tax Cuts and Jobs Act as an Expat?

The Tax Cuts and Jobs act passed with no dramatic changes to expat taxation. The Foreign Earned Income Exclusion, Foreign Housing Exclusion, and Foreign Tax Credit all remain mostly the same and taxpayers with $10,000 or more of financial assets held overseas must continue filing their annual FBAR. Whereas corporations are switching to a territorial based income tax system—individuals will continue to be subject to taxation on their worldwide income.

While the bread and butter of expat taxation is not changing under the Tax Cuts and Jobs Act, certain expats will see some changes around the edges (or the crust, if you will).

Foreign Earned Income Exclusion Changes

One great aspect of the Foreign Earned Income Exclusion is that it grows over time with inflation. Under the prior law, growth in the Foreign Earned Income Exclusion used the regular consumer price index as its measure of inflation. Going forward, under the Tax Cuts and Jobs Act, the inflation measure will change to the chained consumer price index. Without dragging you down into the economic weeds, this will have the effect of slowing the growth in the Foreign Earned Income Exclusion. This change won’t be felt immediately, but over many years expats will see the real value of the Foreign Earned Income Exclusion diminish.

Child Tax Credit Changes

One piece of exciting news for expats under the Tax Cuts and Jobs Act is the doubling of the Child Tax Credit from $1,000 to $2,000 per child. The new tax law also increases the refundable portion of the credit to $1,400. This is of particular interest to expats because it is one of the only refundable credits that does not require that you reside in the United States. However, if you want the refundable portion you’ll have to claim the Foreign Tax Credit (and not the Foreign Earned Income Exclusion), making this a benefit mainly for expats in high-tax countries.

Estate Tax Changes

The number of individuals and families subject to the estate tax will fall dramatically under the Tax Cuts and Jobs Act. For individuals the exemption will more than double from $5.49 million in 2017 to $11.2 million in 2018. Couples will receive double, a $22.4 million exemption.

Deduction & Exemption Changes

Some of the most sweeping changes to the individual tax code are to deductions and exemptions. Personal exemptions are eliminated in favor of a near doubling of the standard deduction. This is likely to have the effect of increasing the tax liability for large families that had multiple personal exemptions, and lead to a small tax decrease for individuals, couples, and small families.

The biggest effect of the doubling of the standard deduction will be the reduction of taxpayers that will see a benefit from itemizing their deductions. An individual will now need more than $12,000 (and couples $24,000) of itemized deductions before surpassing the standard deduction.

Two changes to deductions that could further impact expats are the Mortgage Interest Deduction and the Moving Expense Deduction. Taxpayers will now only be able deduct interest on the first $750,000 of their mortgage, down from $1,000,000. Unfortunately, the Moving Expense Deduction (which helped reduce moving costs for expats moving in and out of the U.S.) is fully eliminated.

Tax Rates & Bracket Changes

While the number of tax brackets was not reduced in the final version of the Tax Cuts and Jobs Act, many of the rates were lowered, including the top rate which fell from 39.6% to 37%. Meaning the highest-income taxpayers should see a big reduction in their tax liability.

Corporate Tax Changes

The biggest changes to the tax code are reserved for corporations. The Tax Cuts and Jobs Act moved the U.S. to a territorial based system for corporate taxation and slashed the top rate from 35% to 21%. To transition to the new system, corporations that have been holding untaxed overseas profits abroad will be subject to a one-time deemed repatriation tax of 15.5%.

This change could also affect expats that own a foreign corporation outside of the U.S. with untaxed overseas profits. The one-time deemed repatriation is not only for multinationals, but will apply to individuals with relatively small corporations as well. A small silver lining is that the law allows for payment of the tax over a period of eight years or all at once. Yay for 0% financing!

Do You Have Questions About How the Tax Cuts and Jobs Act Affects you as an Expat? Leave Them in the Comments Below!

Resources and Tax Forms:

- Tax Cuts and Jobs Act: Full Text

- Tax Guide for U.S. Citizens and Resident Aliens Abroad