Estate taxes (often incorrectly referred to as inheritance taxes) are paid by the deceased and their beneficiaries do not owe any tax on the assets they receive. If you’re considering retiring to the UK, continue reading to learn how estate taxes and associated gifting rules compare between the UK and US.

(Read Remittance Basis of Taxation in the UK to learn about general taxation of Americans in the UK).

Part 1: Estate Tax

What are inheritance and estate taxes?

Before discussing the rules of these types of taxes, it is important to walk through some “death tax” basics. While technically different, the terms estate tax and inheritance tax are often used interchangeably.

Estate tax: Tax paid by the estate of a person who died, aka a “decedent”.

Inheritance tax: Tax paid by a surviving descendent that receives inheritance from a decedent’s estate.

(Super confusing, please note the similar terms–decedent and descendent.)

Do the UK and US both have estate taxes?

Both the US and the UK have estate taxes (though both countries often incorrectly refer to them as inheritance taxes). These taxes are paid by the deceased (decedent), and their beneficiaries do not owe any tax on the assets they receive.

The UK and US systems work in a similar manner: A decedent’s assets (including real estate, property, money, assets, and possessions) are added up, a base exemption amount is subtracted, then a tax rate is applied to calculate the amount due.

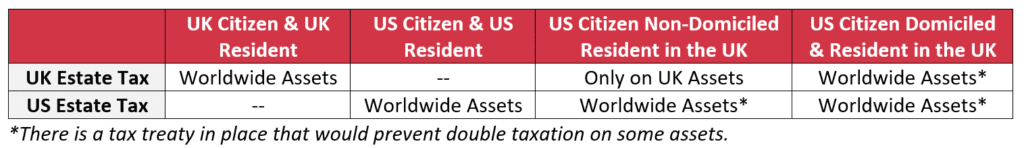

US citizens are subject to US estate tax on their worldwide assets, regardless of their residence or domicile at the time of death. This contrasts with the UK, where domiciled individuals are taxed on their worldwide assets, but non-domiciled citizens and non-residents are only taxed on their UK assets.

How do I know if I’m domiciled in the UK?

Domicile usually happens one of three different ways:

- Origin: You’re a UK citizen and the UK is the location of your permanent home.

- Choice: You decide that the UK is the location of your permanent residence.

- Time: You’ve been a UK tax resident for at least 15 out of the last 20 years.

With this framework in mind, let’s dive into the specifics and some examples.

What are the estate tax rules in the UK?

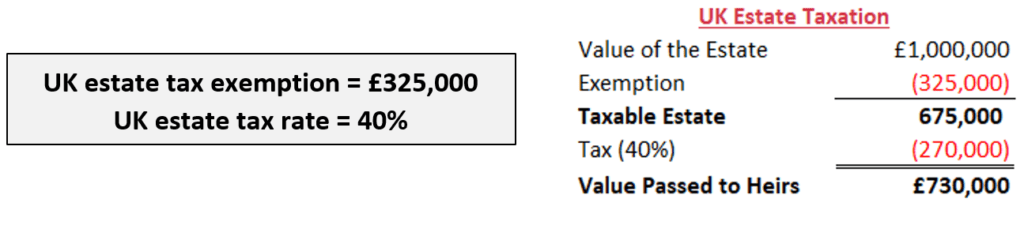

In the UK, estates under £325,000 are not subject to estate taxes, and estates valued above the exemption are subject to a 40% tax on the excess. Here’s a simple example for someone domiciled in the UK that passes away with a £1,000,000 estate:

In this example, £675,000 of their estate would be subject to a 40% tax rate. They would owe £270,000 in taxes and the remaining £730,000 would go to their heirs.

Are there any special rates or additional exemptions in the UK?

There are a few special cases:

- Primary Home: The UK allows you to pass your primary residence to your spouse tax free. If you leave your home to your kids or grandkids, you may qualify for an additional £175,000 exclusion. In the example above, this would bring your total taxable estate to £500,000. Note that only estates valued at less than £2M qualify.

- Business: If you own a business in the UK, you may be able to discount the value for taxation purposes on certain assets.

- Charity: If you leave at least 10% of your estate to charity you may qualify for a reduced estate tax rate of 36%.

How does the UK estate tax compare to the US rules?

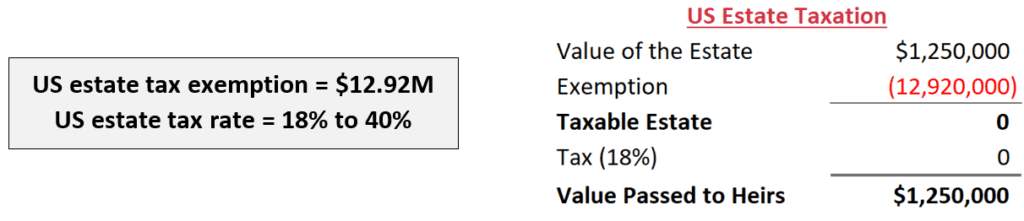

The US estate tax has a much higher exemption than the UK ($12.92M vs. £325,000). Also, instead of a flat estate tax rate like the UK, the rate in the US starts at 18% and rises to 40% for estates valued more than $1M above the exemption amount.

Let’s review another simple example for a US citizen that passes away with a $1,250,000 estate (the current exchange rate equivalent of the £1,000,000 estate in the UK example).

Because the US has a much higher estate tax exemption, they would not be subject to any taxation upon death. Their heirs would receive the entire value of their estate tax-free.

How would estate taxes work for an American who wants to retire in the UK?

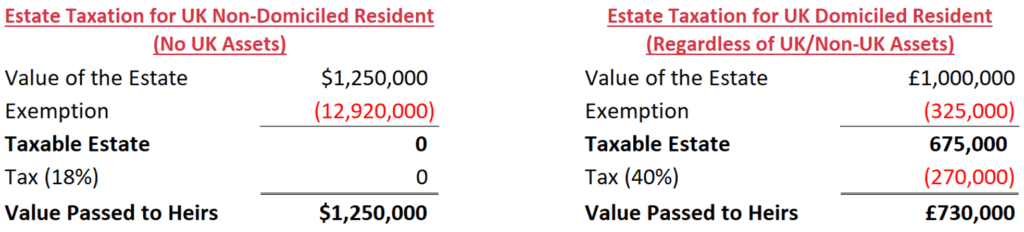

Let’s imagine you are an American with a $1,250,000 (£1,000,000) estate and you want to retire in the UK. Now consider two scenarios:

- You are a non-domiciled resident of the UK when you pass away. You have no UK assets.

- The result: No estate tax because you’re only subject to taxation in the US and all of your assets fall below the exemption.

- You are domiciled in the UK when you pass away.

- The result: Still no estate taxes in the US because you are below the exemption, however now you’re subject to UK estate taxes regardless of whether or not you have UK assets. Your £1,000,000 estate would have to pay £270,000 in taxes in the UK.

You should do what makes you happy in retirement, though it’s worth knowing that if you retire in the UK and become domiciled (either through choice or time) your heirs will be out £270,000!

Part 2: Gifting

No discussion of estate taxes would be complete without touching on gifting. That’s because the best way to avoid paying estate taxes is to reduce the size of your estate, and the quickest way to reduce your estate is to give away your assets.

Are there limitations on gifting in the UK?

Annual exemption: UK residents are allowed to give away £3,000 per year tax-free. Anything above the exemption is subject to a lookback period.

Lookback period: The UK has a seven-year lookback window on gifting. Assets transferred in excess of the £3,000 exemption in the seven years leading up to your death are added back to your estate. Gifts transferred more than seven years prior are completely estate tax free.

Spousal exemption: Transfers between spouses are not subject to gift limitations or estate taxes if the receiving spouse is domiciled in the UK. If the receiving spouse is not UK domiciled, the spousal exemption is limited to £325,000. This is in addition to the base £325,000 for a total of £650,000 that could pass estate tax free to a non-domiciled spouse.

Other exemptions: There are also exemptions for small gifts (under £250), birthdays, holidays, weddings, and regular payments to support someone’s living expenses out of your income.

How do the UK gift rules compare to the US rules?

As with the estate tax, the gifting rules are more lenient in the US as compared to the UK.

Annual exemption: The 2023 annual exemption in the US is $17,000 per donee (not per donor, as it is in the UK). For example, a US resident can give $17,000 to each of their three children before exceeding the exclusion (a total of $51,000). A UK resident with three children can only give each child £1,000 before maxing out their exclusion.

Lifetime exclusion: Assets gifted above the annual exclusion amount start using up your lifetime estate tax exclusion amount of $12.92M in 2023. There is no lookback period in the US.

Spousal exemption: Just like in the UK, the US offers an unlimited exemption for transfers between spouses that are US taxpayers. If the receiving spouse is not a US taxpayer (a non-resident alien in US terminology), then tax-free transfers are limited to $175,000 per year (2023 figure).

Other exemptions: Because the per-donee exemption is so large in the US, there is no need for a “small gift” exemption similar to the one in the UK.

How does this all come together?

The differences and similarities between the UK and US systems create numerous planning opportunities depending on each person’s scenario. Some final thoughts:

US citizen in the UK: The lower exemption amount for UK estate taxes creates a huge incentive for Americans living temporarily in the UK to consider non-domiciled status. This would allow their non-UK assets to pass to their heirs free from UK estate tax.

Married couple, one domiciled in the UK and the other not: There is a lot to consider here with regard to estate tax and gifting strategies. For example, if the domiciled spouse is expected to live 7+ years (exceeding the UK lookback period), it may be advantageous to make a large gift now to their non-domiciled spouse. Or, it may make sense for the non-domiciled spouse to elect domiciled status to qualify for the UK’s unlimited spousal exclusion.

Do you have questions about UK estate taxes or gifting? Leave them in the comments below!

Resources and Tax Forms:

- US Estate Tax and Gifting: https://www.irs.gov/businesses/small-businesses-self-employed/estate-and-gift-taxes

- UK Inheritance Tax: https://www.gov.uk/inheritance-tax

- UK Reduced Inheritance Tax Rate: https://www.gov.uk/inheritance-tax-reduced-rate-calculator

- UK Gifting: https://www.gov.uk/inheritance-tax/gifts

- UK Passing on a Home: