Is Bitcoin Taxable? Is Ripple Taxable? Is Ethereum Taxable?

Yes, almost everything you do with cryptocurrencies is taxable. If you sell them for a profit, you must pay taxes on the gain. If you sell them for a loss, you may be able to deduct all or a portion of your loss on your taxes. If you receive a token for free because of your ownership of that token or another, that is taxed as well.

The IRS has released guidance that states that Bitcoin, and all convertible virtual currencies, are to be treated as property under the tax code, not as a foreign currency.

Are There Tax Consequences for Using Bitcoin to Purchase Things?

Oh boy are there. Although Bitcoin is called a cryptocurrency or digital currency, it’s not currency in the traditional sense of the word (at least not yet). Using it for purchases could create a tax compliance nightmare in which your tax preparation is extremely time consuming or opens you up for a painful audit should the IRS decide to focus on the taxation of cryptocurrencies.

Why? If you purchase something using a cryptocurrency… let’s go with a cup of coffee… in the eyes of the IRS you’re making two separate transactions. You’re selling a portion of your Bitcoin for $5, then purchasing a coffee for $5. This transaction will flow onto your tax return as a capital gain or loss depending on the price you originally paid for the bitcoin use to purchase the coffee. If you make two or three purchases a day… that’s a lot of extra time you’ll be spending with your CPA this year.

Is Trading in Bitcoin Taxable If it Never Leaves My Wallet or the Exchange?

Yep. The IRS is treating Bitcoin mostly like it would a share of Facebook or any other stock, bond, security, or property. If you buy it and later sell it, you’ve got a capital gain or loss on your hands that is reportable to the IRS. Just because you don’t remove the funds from your wallet or the exchange, doesn’t save the gain from taxation. This is just like a stock sale would be treated in your TD Ameritrade or brokerage account.

Do I Have To Pay Taxes in the U.S. on Bitcoin Traded on a Foreign Exchange?

Yep. The United States taxes its citizens on worldwide income, including capital gains. The location of the exchange does not change the taxation of the cryptocurrency under United States tax law. Not that you’re considering tax avoidance, but it’s nice to know…

How Would the IRS Know about My Cryptocurrencies If My Name isn’t on the Account and it’s in a Foreign Country?

Large variances between your spending, activity within the global banking sector, and the income reported on your income tax returns could raise red flags. What do I mean? If you’re buying a lot of stuff and telling the IRS you don’t have any income, they may start asking questions.

Is Converting or Exchanging One Cryptocurrency for Another Taxable?

Here again, unfortunately the answer is yes. As with the cup of coffee, the IRS views converting one cryptocurrency for another as two transactions. In their eyes you sold Litecoin for US dollars and then purchased Steller for US dollars. You’ll need to report a gain or loss on the Litecoin, and you’ve established a new basis in your Steller position.

For accurate record keeping, you can try Apps that keeps track of your transactions. But honestly, many are prone to mistakes if you’re using multiple exchanges and you should keep a detailed Excel spreadsheet too.

What is the Tax Rate on Cryptocurrencies?

Cryptocurrencies are taxed at normal capital gains tax rates. Short-term gains (held for less than a year), are taxed at your normal income tax rate (same as wages or interest), whereas long-term gains are taxed at a preferential rate (which in most cases is 15%).

Losses on cryptocurrencies can be netted against gains and the excess can be deducted up to $3,000 per year.

How is Cryptocurrency Mining Taxed?

Any cryptocurrencies received through mining are taxed as self-employment income. This income is subject to normal income tax rates, as well as, self-employment taxes (Social Security and Medicare). The good news is that your mining income can be offset by your business expenses: computers costs, electricity, renting a facility, utilities, repairs, maintenance, etc.

How are Coins Received Through Staking a Cryptocurrency Taxed?

Some cryptocurrencies will pay you a coin or token as payment for staking your coins to support the validation process. For example, holders of NEO coins receive GAS tokens for staking their NEO. These GAS tokens have a monetary value on exchanges and are freely tradable.

As with many aspects of cryptocurrency taxation, the IRS guidance on staking isn’t clear. The more conservative approach would be to treat this income just as you would mining income, subjecting it to normal tax rates and self-employment tax. The more aggressive position would be to consider staking income as interest, just as an investor would received in a bank account.

Under either method, the U.S. dollar value of the token on the day you receive it should be included in income and will be taxed at ordinary income rates (just as interest or a non-qualified dividend would be). Conservative investors should also consider paying self-employment tax.

My Wages Are Paid in Cryptocurrency, How Do I Pay My Taxes?

If you’re working for a U.S. company and they pay you in cryptocurrencies, they are obligated to provide you with a Form W-2 or Form 1099. The forms will be in U.S. dollars and you’ll prepare your taxes just like normal.

If you’re working for a non-U.S. company, you’ll need to list out every payment you received in cryptocurrency, the date, and the U.S. dollar exchange rate on that day. Getting into the habit of keeping accurate records can save you a lot of time come tax season.

You should also request a “wage statement” from your employer. This won’t be an official IRS form, but should include the following elements:

- A letter on the company’s stationary.

- Signed by the HR department or someone on the leadership or executive team.

- That states your name.

- That lists your total compensation for the year, in each cryptocurrency received.

When Are Cryptocurency Taxes Due?

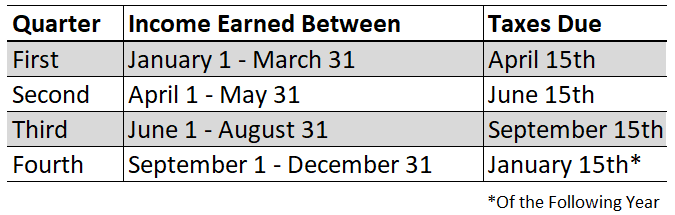

Although your tax return is due April 15th, you should be paying taxes throughout the year, just like you do when they are withheld from your paycheck. This can save you from incurring large penalties when you file your taxes. Self-employed individuals, day traders, and any taxpayer that has income that is not subject to tax withholding, should get in the habit of making quarterly estimated tax payments. Taxes are due 15 days after the end the period in which the income was earned:

Estimated tax payments can be made online through IRS Direct Pay or through the mail using Form 1040ES. If you live in a state with income taxes, don’t forget about making those estimated payments too! Google your state and “estimated tax payments” to find the proper form or how to pay online.

Do You Have Questions the Taxation of your Cryptocurrencies? Leave Them in the Comments Below!

Resources

- IRS Notice 2014-21: Describes how existing general tax principles apply to transactions using virtual currency.

- Due Dates: Estimated Tax Payments

- Pay Your Taxes Online: IRS Direct Pay

- IRS Form 1040ES: Estimated Tax for Individuals