Last week I provided you with 5 Reasons to Contribute to Employer-Sponsored Retirement Plans (ESRPs). Assuming you’re sold on my advice to contribute, now the question is: “Well, should I contribute to a Traditional or Roth account?” Immediately following that question is, “and what’s the difference between them anyway?” Today I will answer both of those questions for you. If you are unsure of what an ESRP is and why you should contribute please check out last week’s blog here!

Not all employers offer retirement plans, and those that do have different offerings. Even if your employer doesn’t offer an ESRP, or both a Traditional and Roth option, don’t stop reading here! There is another type of non-employer-sponsored retirement account, the Individual Retirement Account (IRA), where the same Traditional versus Roth principles apply.

Knowledge Review: Income Taxes

Before we can recognize the differences between contributing to a Traditional or Roth retirement account, we must have an understanding of how our income is taxed. (If you know your tax lingo, feel free to skip ahead to the next section.) Not all income is created equal! There is ordinary income (e.g., wages, salary, tips, interest, short-term capital gains) and preferential income (e.g., long-term capital gains, qualified dividends).

A capital gain or loss is the difference between the purchase price of an investment and the price at which you sell it. The gain or loss is considered long-term if the investment was held for longer than one year.

For a dividend to be considered qualified it must come from a U.S. corporation to a shareholder of at least 60 days.

Taxable income is your income after subtracting exemptions and deductions.

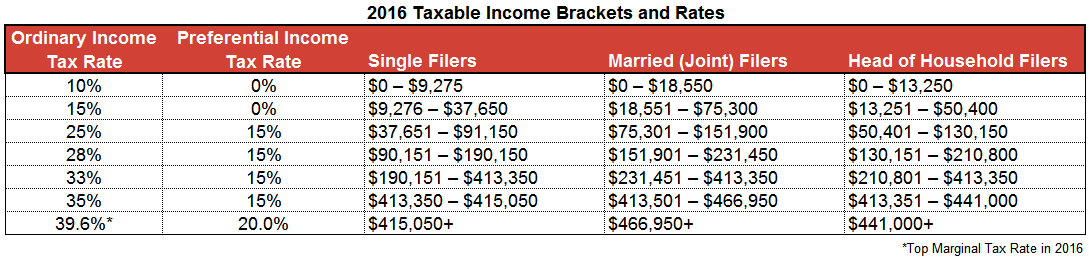

Ordinary income is taxed on a progressive scale, meaning taxpayers who make more money pay a higher percentage as taxes. Taxpayers progress through the tax brackets, as their income fills one bracket, it graduates to the next. Using the 2016 tax brackets and rates as an example (see the table below): The first $9,275 of a single taxpayer’s taxable ordinary income would be taxed at 10%, from $9,276 to $37,650 it would be taxed at 15%, and so on.

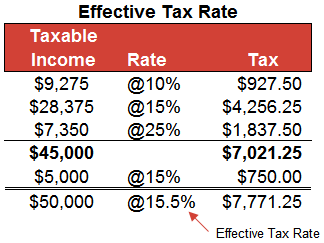

Preferential income is also taxed on a progressive scale, but at a lower rate than ordinary income. All taxable ordinary income is applied first to fill the lower brackets, then taxable preferential income is added on top, graduating from one bracket to the next just as taxable ordinary income. Again using 2016 figures, if a single filer has $45,000 of taxable ordinary income and $5,000 of taxable preferential income, she would be taxed as follows: The $45,000 of taxable ordinary income would fill the 10% and 15% brackets with the remainder falling into the 25% bracket. The $5,000 of taxable preferential income would be taxed entirely at 15% because the taxable ordinary income would fill up the lower brackets.

The top marginal tax rate is the highest rate at which a portion of a taxpayer’s income may be taxed during a tax year. For 2016 the top marginal tax rate (indicated with an asterisk) is 39.6%, and it applies to taxable ordinary income above $415,050 for single filers.

When talking about taxation, we often refer to an effective tax rate, or the average rate at which a taxpayer is taxed. For example: using 2016 figures, if a single filer had taxable ordinary income of $45,000 and taxable preferential income of $5,000, their effective tax rate would be 15.5% (calculated below).

Roth and Traditional: What’s the Difference?

All five reasons to contribute to ESRPs (the prior blog post linked above) hold true for both Traditional and Roth accounts. Where the accounts differ is within reason #2: tax advantages. You may recall:

Tax-free growth is not the only tax advantage retirement accounts have over non-retirement accounts. If you make contributions to a Traditional retirement account (as opposed to a Roth account), that amount is subtracted from your annual income for the computation of income taxes, reducing the amount of taxes owed.

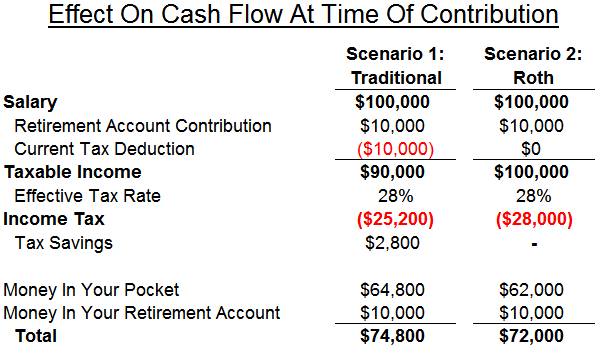

That’s it, the major difference is right there—the timing of taxation. When you make a contribution to a Traditional account, that amount is subtracted from your taxable income in the year of the contribution (i.e., a tax deduction), reducing the amount of taxes owed. However, when withdrawals are taken from the account (normally in retirement), the amount is added to your taxable income in the year of the withdrawal, increasing the amount of taxes owed. A Roth account is taxed in the opposite direction. Income contributed to the Roth account is taxed in the year it is earned and contributed, but is not subject to taxation when it is withdrawn. So what does this look like? Let’s review two different simplified scenarios, both of which assume you have a salary of $100,000 and an effective tax rate of 28%:

- You make a $10,000 contribution to a Traditional retirement account.

- You make a $10,000 contribution to a Roth retirement account.

As you can see, the tax-deductible contributions to a Traditional retirement account lead to lower taxes in the year of the contribution and more money in your pocket. “Ok, so if Traditional accounts come with a tax deduction, why would anyone contribute to a Roth account?” Well, making the right decision is about considering your effective tax rate at each point in time—now and in retirement—and your current cash flow needs.

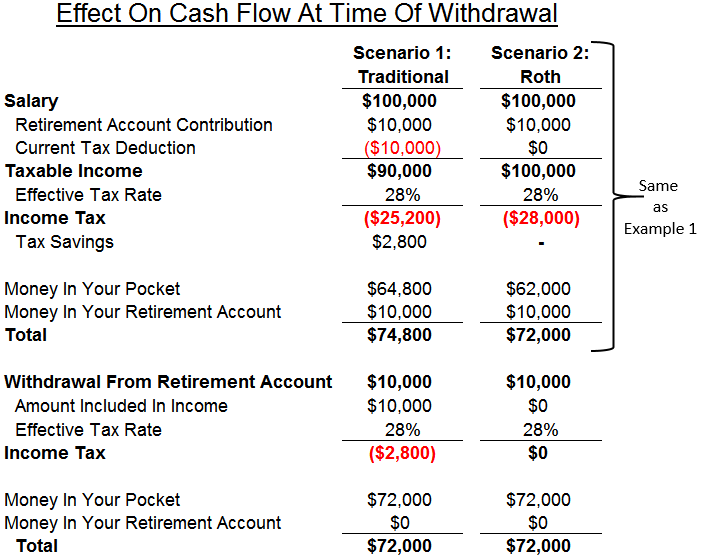

Let’s continue the example and show what happens when you withdraw funds assuming the same effective tax rate in retirement.

As you can see, holding the tax rate constant, the only difference is the timing of taxation—you actually net out equally. Now the question becomes: “Why would anyone want to prepay their taxes? If I just invest that money instead, won’t I end up ahead?” The answer here is surprisingly no, because of the benefit of tax-free growth in the retirement account and the effects of tax drag on the invested tax savings.

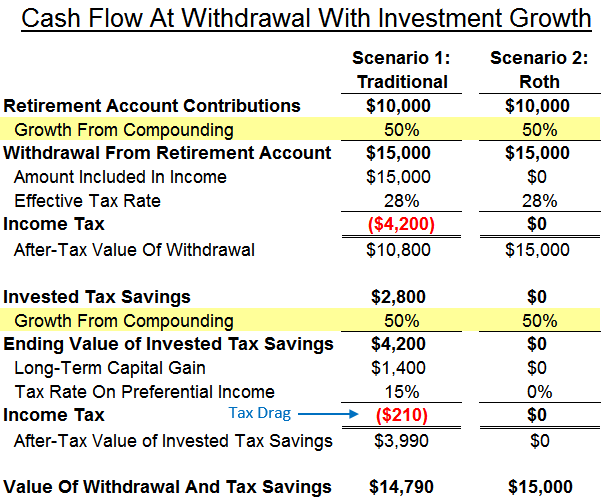

Let’s revisit Example 2 above, Cash Flow Effect At Time Of Withdrawal. However, to make it more realistic this time we’ll incorporate a 50% rate of growth from compounding (reasonable if invested for 10-30 years) for both the retirement account contribution and invested tax savings.

The ending value of the withdrawal and tax savings is slightly lower ($210) for the Traditional account because of the effects of tax drag (having to pay taxes on the growth). It may not seem like much of a difference, but this was an overly simplified example using small dollar amounts. In reality, retirement accounts may be larger in size and the growth of the invested tax savings may be taxed each year, increasing tax drag to a value larger than shown here.

This example illustrates that when holding the tax rate equal, making a contribution to a Roth account is more beneficial. This is because the earnings on the investments within the Roth account are never subject to income taxation, while the value of the invested tax savings is brought down by tax drag.

Roth and Traditional: How To Decide

Now that you understand the major difference between a Traditional and Roth account, you are better prepared to decide which account type is best for your retirement savings. Each account type has pros and cons and the most beneficial account type depends on your individual situation! Below are your key considerations…

Current Versus Future Tax Rate

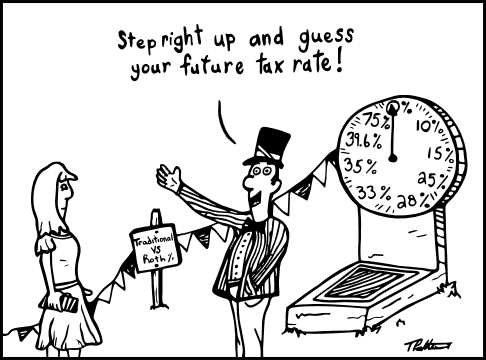

In the scenarios above, the tax rate was assumed to be equal now and at the time of withdrawal. In reality, that’s probably not going to happen. Not only will your income be different in retirement, but tax laws may be different. We are currently experiencing a period of exceptionally low income tax rates (see A Brief History: Roth Accounts at the end of the post), and there is no sure way to know where they will go from here. (Maybe we won’t even have income taxes in the future, there will be higher sales taxes!) Even so, you still should consider your current and future tax rates when choosing between a Roth or Traditional account. tpattersonart.com

tpattersonart.com

If your current effective tax rate is 39% and you know you’ll have low income in retirement, making tax-deductible contributions to a Traditional account could generate tremendous savings! Every dollar contributed now could save you $0.39 in current taxes. That money would be taxed in retirement, but possibly at a much lower rate because your overall income will be lower. On the flip side, you would want to contribute as much as you could today to a Roth account, if your current tax rate is 0% and you know in retirement you will be taxed at 39%. Every dollar contributed now could save you up to $0.39 in future taxes.

With so much uncertainty in the future, how can we make a decision? Assuming our 100-year-old income tax system doesn’t fall to the wayside during your lifetime, you may consider a few general guidelines:

- If you are currently in the 10% or 15% ordinary income brackets (the lowest two), you may want to assume your effective tax rate will be higher in retirement and you may benefit from making contributions to a Roth account.

- If you are currently in one of the highest ordinary income brackets (33% or higher), you may want to assume your effective tax rate will be lower in retirement and you may benefit from making tax-deductible contributions to a Traditional account.

- If you find yourself in a middle ordinary income bracket, it may be a toss-up whether your tax rate will be higher in retirement, and there are a few other considerations that may help you make a decision. Read on.

Short-Term Cash Flow Needs

Although Roth accounts (where you “pre-pay” your taxes) are mathematically beneficial in the long run when holding tax rates equal, it may not be the best option if you have short-term cash flow needs. You may have debt (student loan or credit card), insufficient emergency savings, or be working toward an immediate goal (e.g., buying a car or a house). If you have cash needs, but would still like to contribute to a retirement account, a Traditional account may be the way to go. By reducing your current income tax liability, Traditional retirement account contributions allow you to maximize your current cash flow while still receiving any employer match and saving for retirement.

Required Minimum Distributions (RMDs)

If you have reviewed your tax brackets, made an assumption about your tax rate 40 years into the future, considered your current cash flow needs, and still find yourself undecided, there is one last piece of information to consider—RMDs. “What’s an RMD?” Starting in the year you turn 70 ½ (with some exceptions) the IRS requires you to begin taking annual distributions from your Traditional retirement accounts or be penalized. These required distributions are added to your taxable income in the year of withdrawal (because they are from a Traditional account), increasing your tax liability, and no longer benefiting from tax-free growth. Roth accounts, by contrast, are not subject to RMDs. This means that Roth accounts have two additional advantages:

- Since you are never required to withdraw funds from the account, your contributions can continue to compound without being subject to income taxation for longer.

- You have more control over your income tax liability. (RMDs could move you into a higher tax bracket if you decide to continue working past 70 ½.)

Mix It Up

Your optimal account type—Roth versus Traditional—may change over time, even during the same year. Don’t be afraid to make adjustments! You may get a raise, get married, have a child, inherit money, or the tax rates may change—all of these factors can have an impact on your decision. It may also be possible for you to contribute to both at the same time, in which case you may want to hedge your bets and enjoy some of the advantages of each. Many employers allow mixed contributions and for you to make changes to your account type on a frequent basis. You don’t need to make a decision and stick with it forever. Consider changes when they happen and reevaluate the situation.

Conclusion

When making the decision between a Traditional and Roth retirement account there are many factors to consider—your income, current tax rates, future tax rates, your cash flow, and RMDs. Your tax rates at the time of contribution and withdrawal are the most significant, but are also subject to a large degree of unpredictability. To make the best decision for your individual situation, consider the differences between the accounts, weigh what is important to you, and then focus on contributing as much as you can. Your overall contributions will be the true long-term predictor of your retirement success. The account type will only be a secondary factor.

Have you ever wondered where the Roth account got its name? Keep reading to find out!

A Brief History: Roth Accounts

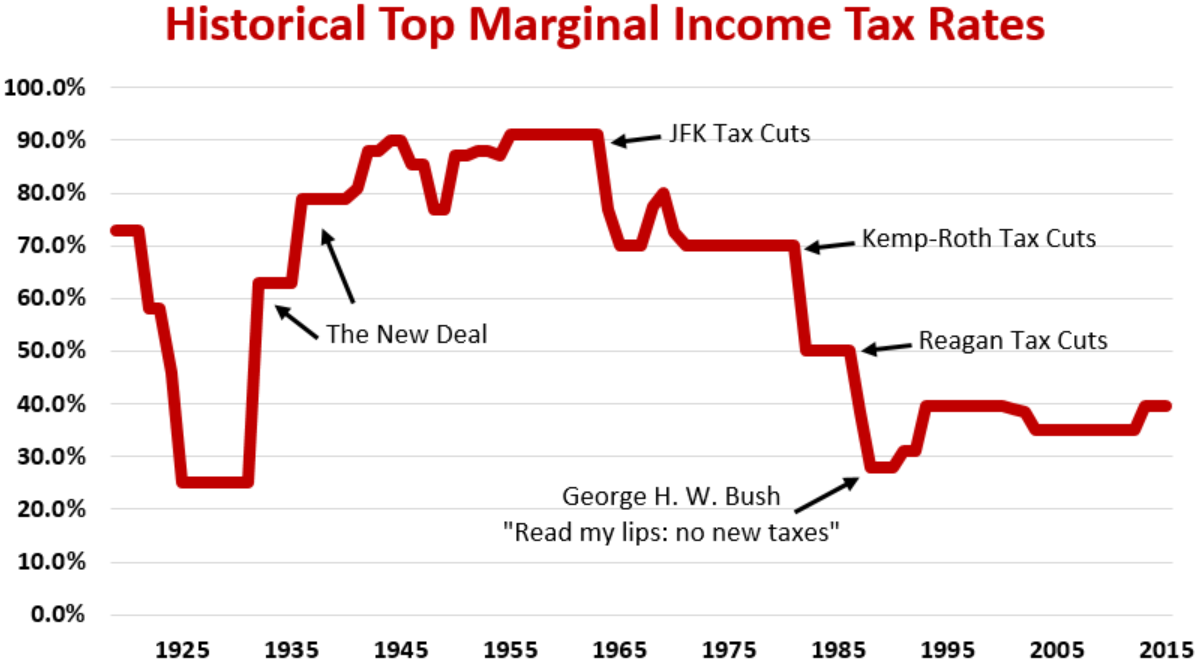

William Roth was a five-term Republican Senator from the state of Delaware, who wasn’t afraid to cross party lines and vote his beliefs, as he did with gun control and environmental protection. In spite of some of his more liberal views, he was best known as a fiscal conservative that consistently fought to reduce taxes. Before he co-sponsored the Economic Recovery Tax Act of 1981, better known as the Kemp-Roth tax cut, the top marginal tax rate was consistently above 60%. It’s hard to believe tax rates were ever so high! The truth is we are currently experiencing a long period of historically low rates (see chart below).

Although Senator Roth is best remembered by many for his Regan era sponsorship of the 1981 tax cuts, it’s his co-sponsorship of the Taxpayer Relief Act of 1997 that added his name to the common lexicon. The act created a new type of individual tax-advantaged retirement account called a Roth IRA (originally called an IRA Plus). The Roth IRA proved so popular that in 2001, Congress gave employers temporary authorization to offer Roth 401(k) and 403(b) ESRPs, and the Pension Protection Act of 2006 provided permanent authorization.