You know retirement plans are awesome because you read the 5 Reasons to Contribute to Employer-Sponsored Retirement Plans. Now you’re like “This lazy money needs to be invested and start working for me! I’m trying to retire ASAP!” Fortunately, Becky, from HR, was kind enough to drop off a stack of papers containing your investment choices—but where do you start? I’ve laid out three simple steps to help you make the right choices quickly: 1) select your time commitment, 2) get diversified, and 3) review the fees.

Step 1: Select Your Time Commitment

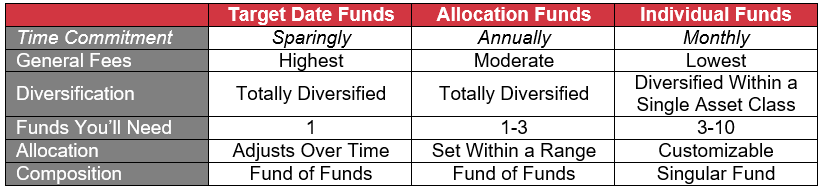

When you sign up for your retirement account you’ll be provided with a lot of paper or access to an online account (or both). Somewhere in the sea of information will be a listing of all your investment options. Each retirement plan has different offerings, but most will have three main categories of investment fund choices: target date, allocation, and individual. The major differences between these funds are the time commitment needed to effectively manage your account and cost.

What are Individual Funds?

An individual fund is simply a collection of investments. Each one has a manager (robot or human) that chooses a few hundred or thousand individual stocks and/or bonds. They come in all shapes and sizes and package together investments to provide quick diversification within a broad array of categories. An individual fund may be entirely composed of companies that specialize in cyber security, are located in Hong Kong, or have CEOs that listen to the Beatles—it could literally be anything. Although you can invest in funds that are organized around just about any idea, we are most interested in the ones that are deemed “index” funds, because they are organized around an asset class and have the lowest fees. (More on why both of these are so important later in the post.)

What is an asset class?

An asset class is a group of investments that exhibit similar characteristics. An asset class can be very broad (such as stocks or bonds) or it can be more granular (such as large company stocks or developing country bonds).

Individual funds require the greatest time commitment

Depending on the choices available in your retirement account, you’ll need to select three or more individual funds to build a diversified portfolio. (This is explained later, but for now just know that a diversified portfolio is one that contains all the key asset classes.) Beyond requiring more initial setup time, individual funds require more monitoring and rebalancing.

When you initially build a portfolio, you choose a certain percentage that will be invested in various asset classes. Over time, these investments will perform differently. Your cyber security fund may go up, while the CEO Beatles fan fund may go down, constantly changing the percentages of your portfolio invested in each.

Let’s say you initially invested 50% of your retirement account in stocks and 50% in bonds. Over the last 5 years your stock investment grew 50%, while your bonds fell 5%. Your portfolio will now be more than 60% stocks and less than 40% bonds, far from your initial 50/50 allocation. You may want to rebalance back towards your initial allocation because your current portfolio has become too risky (too much in stocks). To do this, you would sell some of your stocks and purchase bonds. Rebalancing is important to successful investing because it keeps your account at your desired risk level.

What are Allocation Funds?

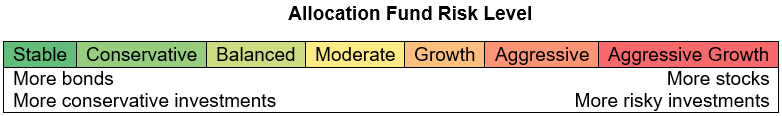

Allocation funds are a group of individual funds (or fund of funds) packaged together. They may allow you to achieve full diversification with the selection of just one or two funds. They are generally organized by risk level, and each level signifies a different percentage of investments in stocks versus bonds, and further, risky investments versus conservative ones. You can identify these funds because their names usually contain the colorful words (risk levels) in the chart below.

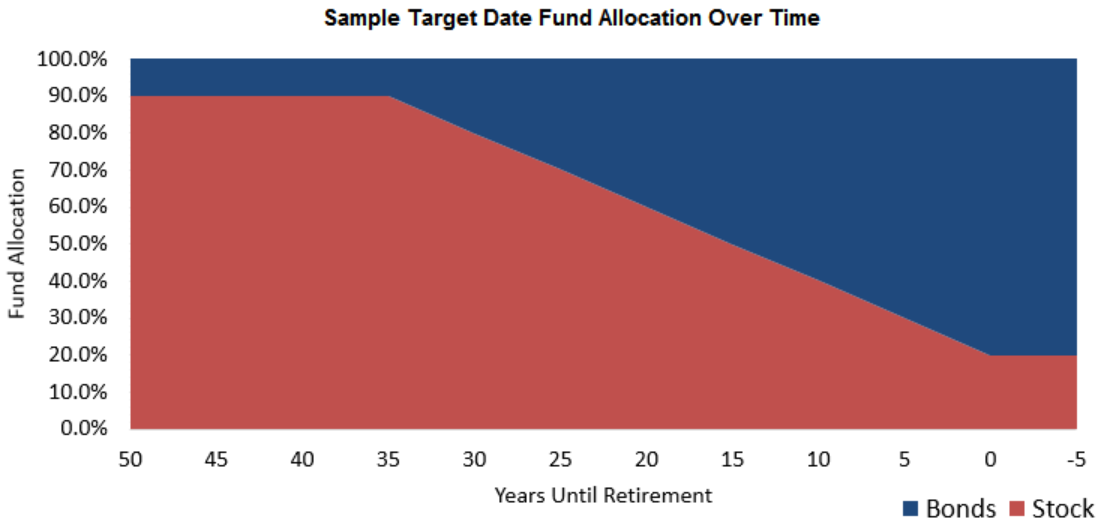

Allocation funds have a target range for the percentage to be invested in stocks versus bonds. When the fund deviates from this range, the fund manager rebalances. This reduces your required time commitment, but increases your fees to compensate the manager.

Allocation funds still require some time commitment because you may want to reduce your risk as your time horizon decreases (you near retirement). Initially you may select an aggressive growth allocation fund, then adjust down to a growth, balanced, or conservative risk level. This can usually be done annually or every few years.

You may still need more than one fund

As a fund of funds, allocation funds do a pretty good job of giving you a diversified portfolio. However, sometimes they are U.S.-centric funds and do not have any exposure to international or emerging market investments. If this is the case, you can build a fully diversified portfolio by investing a portion of your portfolio in an individual fund to add these missing asset classes along with your allocation fund.

What are Target Date Funds?

Target date funds are easy to identify because they usually have a year in their name. The idea behind these funds is to set and forget. You choose the one that corresponds to your estimated retirement date, save into it throughout your career, and it will automatically rebalance and reduce risk over time. A target date fund is a fund of funds that provides full diversification and requires almost no work on your part. For this reason, they are generally the most expensive option.

How Much Time Do You Want to Commit?

You can build a proper investment portfolio using any of the three main categories of investment fund choices—target date, allocation, or individual. The choice becomes: Do you want to be actively involved in managing your retirement account or pay someone else to do it? Wait! Before you answer that question, you should know the work involved with being diversified (step 2) and consider the fees of each strategy (step 3).

Step 2: Get Diversified

No matter which investment category you use, your portfolio should be diversified (include exposure to all the major asset classes). This means you should invest in a broad selection of stocks and bonds, with a mix from the U.S. and international, developed and emerging economies, big and small companies, and different industries.

Building a diversified portfolio is like throwing a high school house party in the movies. The secret to success is having all the different cliques (or asset classes) mingling together in one place. In the movies, this is how the nerdy romantic boy is finally able to ask his lifelong-neighbor, the popular girl, to senior prom. In your retirement account, it’s how you achieve investments returns while reducing wild swings in the account value.

tpattersonart.com

tpattersonart.com

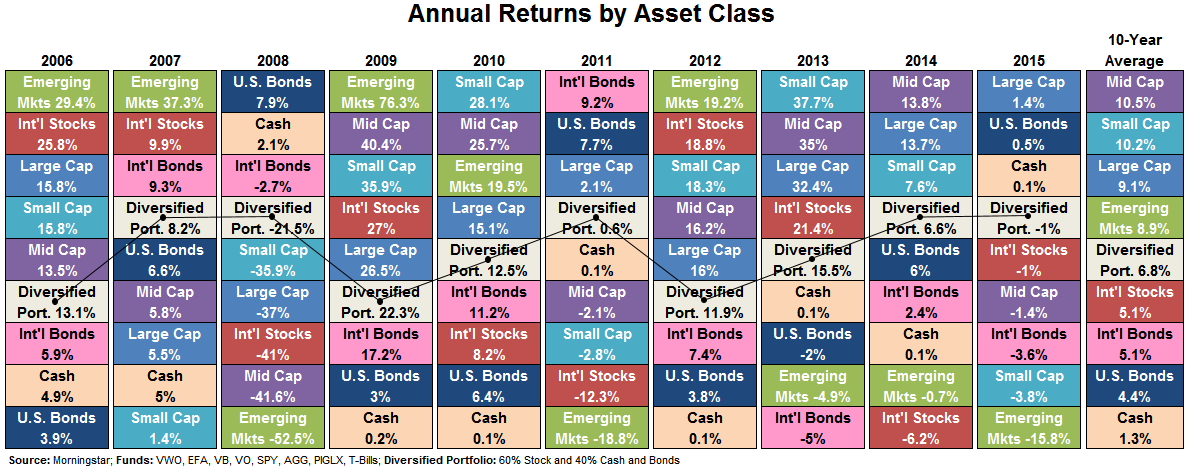

Diversity reduces volatility because no single asset class performs consistently well year after year. Trying to identify the one that will perform well is a fool’s game, so owning a broad selection is your best option. Check out the quilt chart below for a visual representation of the annual performance of different asset classes (the colorful boxes), as well as a diversified portfolio (the light-gray box tracked along the middle).

As you can see, the diversified portfolio is much less volatile than any single asset class. It consistently remains in the middle of the pack without subjecting you to extreme losses in a single year. Building this type of diversified portfolio with exposure to thousands of companies and dozens of countries across the globe is simple using the three fund categories discussed above.

As you can see, the diversified portfolio is much less volatile than any single asset class. It consistently remains in the middle of the pack without subjecting you to extreme losses in a single year. Building this type of diversified portfolio with exposure to thousands of companies and dozens of countries across the globe is simple using the three fund categories discussed above.

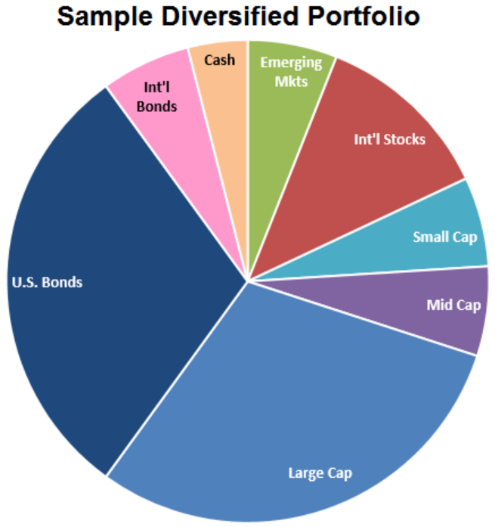

My sample diversified portfolio is made up of seven different funds (plus cash). Each one provides exposure to a different key asset class: large, medium and small cap U.S. company stock, international stock, emerging market stock, U.S. bonds, and international bonds. These seven asset classes are the basis for the standard diversified portfolio.

No matter which category of investment funds you choose to utilize in your retirement account, you should insure that it’s properly diversified. This is another point at which level of effort comes into play. Most target date funds are already properly diversified, allocation funds may need additional international exposure, and individual funds require multiple funds to hit all the key asset classes.

Step 3: Review the Fees

The final step, after choosing your time commitment and making sure you’re diversified, is reviewing the fees. There is a cost to using funds to efficiently diversify your portfolio. Each one charges an expense ratio, or fee, for organizing, selecting, and managing the individual investment components.

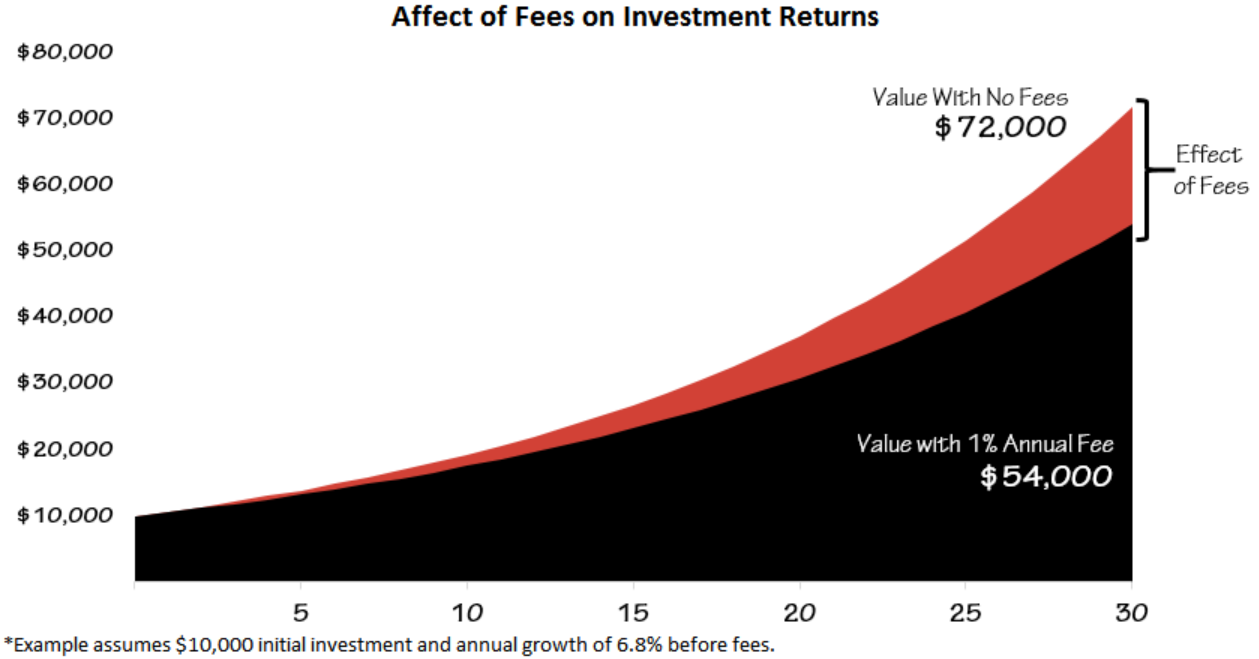

Fees are the price of convenience and keeping them low is important because they can eat into your investment performance over the long-term. The chart below shows the growth of a $10,000 investment over 30 years and how a 1% annual fee would affect its growth.

Over 30 years, the fee wipes out about $18,000 (25%) of the potential final value. You’re not going to be able to find funds with no fee, but if you’re willing to do your own rebalancing you can find low-cost ones.

What is an acceptable fee?

Fund fees vary from near zero to well above 1%. Some factors that may cause a fund to be more expensive are: international investments, small industries, active managers, or investing in things like real estate or gold. Although these factors can influence the price, the fund manager and company have discretion to set their fee as they wish. The three fund categories have very different standard fees:

Target Date Funds: About 1.0%

Allocation Funds: 0.8% or less

Individual Funds: Above 1.0% to less than 0.1%

How do you identify a fund’s fees?

You’ll rarely see the fees you pay deducted or broken out. They are simply removed from the performance. Finding the fund fees may or may not be easy. Unfortunately there is no universal way this information is presented and each retirement plan is different. Your company may offer a list of investment choices that shows the fee involved very clearly or you may need to dig through papers or the website provided.

Look for terms like “prospectus”, “fact sheet”, “research investments”, “investment options”, or “fund details”. The fee will likely be shown as a percentage such as “0.35%” and may list terms like “gross” and “net”. This percentage indicates that the fund costs $3.50 for every $1,000 invested, or 0.35% of the invested amount annually. Often times the “net” and “gross” fee are equal, the “net” fee is one you pay.

Because retirement accounts have a limited set of fund options, you should compare fund fees on a relative basis. Your plan may offer options with fees that are well above or below the standards listed above. The important point is to be aware of the fees and consider them when making your investment decision.

Conclusion

When choosing how to invest your retirement account remember these three steps: 1) select your time commitment, 2) get diversified, and 3) review the fees. The category of funds you choose (target date, allocation, or individual) will influence the amount of setup and maintenance time required. Choosing a target date or allocation fund makes getting and staying diversified easy, but may reduce the value of your account because of fees.

Look, you know yourself! Don’t feel obligated to choose individual funds just to save money. If rebalancing is going to sit on your to-do list for months and stress you out, choose a target date fund. On the flip side, if you have the habit of being “too active” in the management of your investments, target date or allocation funds may be the way to go. Paying a fee to protect your retirement savings from emotional investment decisions during down markets may be worth it. Finally, if you’re working with a financial planner, ask them for individual fund investment recommendations! This may be the best of both worlds. They can help you keep the fees in your account low and handle the rebalancing.

Are you interested in getting one-on-one advice on managing your retirement plan? Click here to schedule a FREE 30 minute call with David, a Certified Financial Planner (CFP®) professional and Certified Public Accountant (CPA), and get answers to all of your money questions.

As usual, a great summary. One tool I love for checking fees is http://www.feex.com. Provides fees instantly, and you can see the effect over time as your portfolio grows.It’s particularly helpful if you have multiple fund options that have similar risk/reward profiles, so fees can really be the differentiator.

Feex is a wonderful tool. Thanks for sharing!