The Biggest Factor in Financial Success

When it comes to achieving financial success, I have some exciting news for you: Size [of your income] doesn’t matter! You don’t need to inherit a million dollars, nor do you need to win the lottery. If you want to be financially successful, the most important factor is your spending. I’m not advocating that you stop all entertainment, cancel your vacation, and eat ramen noodles for the rest of your life. But if you can save and live within the boundaries of your income, you can be prosperous. This is a reality that is so logical that the opposite holds true as well: if you get in the habit of spending more than you make then you’re doomed. Bottom line.

In theory it’s easy. In practice, not so much. Our spending habits are deeply ingrained from a young age. Many researchers believe that our parents shape our financial tendencies, because we watch their behavior and aspire to emulate them, intentionally or not. Changing these ingrained habits, much like any other habit, takes a full commitment. It takes time, discipline, and sacrifice. But first, you have to know what your habits are.

As You May Have Learned on Shark Tank

One of my favorite shows to watch is ABC’s Shark Tank, where entrepreneurs pitch their ideas to a group of celebrity investors (aka the “Sharks”) seeking an investment in their business. If you’ve ever seen the show, you know the one thing that the Sharks really hate is when the entrepreneurs don’t know their “numbers”—the sales figures, manufacturing costs, customer acquisition costs, etc. The entrepreneurs can have great ideas, dominate the sales pitch, then completely blow it all when they stumble through their numbers. The Sharks start to circle, and take turns crushing the entrepreneur’s dreams of receiving an investment.

Being in control of your personal finances is not unlike running a business. KNOW YOUR NUMBERS. If you don’t track what you spend, you can never have confidence that you are saving and spending the appropriate amounts for a sustainable future. Baby boomers tended to do this by balancing their checkbooks. The simple repetition of hearing an amount, writing it on a check, then writing it again in the check ledger helped them process their spending. If they didn’t pay by check, they used cash. Again the amount would be repeated as they heard it, determined the amount of cash needed, and counted their change. In today’s digital world, we don’t need to think about what we are spending. Swipe, tap, or click and voila! We are the proud new owners of $125 yoga pants or a $15 food truck Bánh Mì. The best that many of us do is log into our accounts and give our online statement a once-over just to make sure there’s still money. It has simply become too easy to give near-zero attention to the actual dollar figures and combined costs of our purchases.

Numbers Don’t Lie

When you don’t track your actual spending, your perceptions are all you have. The bad news is that your perceptions are subject to behavioral biases such as recency. Have you ever returned home from a friend’s wedding weekend and felt like you spent too much, so you cut back the next week? Or maybe you received an unexpected bonus that burns a hole in your pocket until you splurge on some unplanned purchases. These feelings of extreme deficit or surplus are nearly always short lived, but last long enough for irrational behavior to occur. So the million-dollar question: How do we stop our irrational spending behavior?

1. Read the Receipt

A quick once-over of each receipt (or simply looking at prices when you throw something into your cart), will do wonders for your financial life. You will be amazed at what it will teach you over time. You can begin to see trends and realize just how different prices are in different locations. It sounds very simple, but the truth is that most of us don’t do it. I am a curious person and constantly compare prices even when I’m not buying something (you’d be amazed by the range in avocado and cucumber prices!) Sometimes I even find myself thinking of a purchase in terms of other goods instead of the dollar price. “Do I really want this? I could buy two Chipotle burritos for the same price…”

When I met my wife she was living on Capitol Hill in Washington, D.C. We loved to cook dinner together, and she would take me to her go-to corner store (because it was literally on the same block as her apartment). They had all the staples: produce, pastas, and even a few fine wines. However, what they didn’t have were well-marked prices. If you wanted to know how much something cost, you’d have to search all over the packaging, ask the clerk, or just grin and buy it. I loved going there because we never had much time together and you could be in-and-out in less than 10 minutes. I knew the store was more expensive, but everything in D.C. seemed expensive. Once I started to pay attention to the prices as they rung up at the cashier, however, I quickly discovered the true cost of convenience: prices starting at $5. A single pepper, box of pasta, bag of chips… didn’t matter what it was, it cost at least $5.

One day we decided to drive a mile down the road to Safeway and all of a sudden we felt like millionaires. We could purchase a whole basket of food for the same price as a handful of items in the corner store. That Safeway was less expensive didn’t surprise us; everyone knows that the small corner stores are more expensive. What changed is that we could actually quantify the additional expense, and that led to a change in behavior. We could honestly say “driving a mile down the road will save $60.” A powerful incentive.

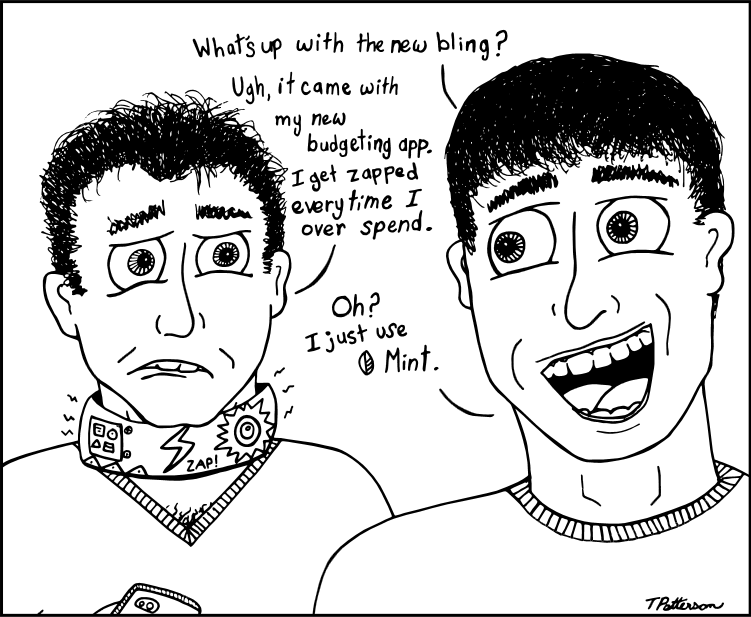

2. There’s an App for That

Don’t let anyone tell you that this is not the best time in history to be alive. There is an app for everything. Expense tracking and budgeting is portable, automated, and incredibly easy. When I started keeping a detailed list of all my expenses, the iPhone was still an idea in Steve Jobs’ mind. My two options at the time were to purchase expensive software like Quicken or keep track manually in Excel. Now, there is a multitude of free options available that aggregate your spending, categorize it, and summarize it for analysis. Wells Fargo, Bank of America, Capital One, Discover, and many other financial institutions offer expense tracking automatically. There are also many specialized apps that not only aggregate your spending, but also help you budget each month.

The most popular app, and the one that I use, is Mint. It only takes a few minutes to sign up and is free to use. It allows you to connect your bank accounts, credit cards, and even your mortgage by using your online logins. Once connected, Mint will download your activity, gather your expenses, categorize them automatically, then summarize your financial information and display it using colorful, easy-to-understand graphics.

The software is not perfect from the get-go and does require a bit of clean-up time. While it is able to categorize your purchases relatively well and learns from your behavior, it will never be able to tell the difference between the 24-pack of toilet paper and bike shorts that you ordered on Amazon—it simply sees Amazon. I find it best to check the app every few days to make sure things are being categorized correctly (including splitting bulk purchases on Amazon). Because it’s an easy-to-use app, you can do your periodic clean-up without too much effort while you wait in line or ride the bus. If you stay on top of it, it is easy to identify which expenses need to be categorized and avoid a scramble at the end of the month to clean up everything. With this and other similar apps, there is no need to keep receipts, enter expenses into Excel, or search for a one-cent variance in your checkbook. At first it may seem tedious, but it will save you time in the long run.

tpattersonart.com

tpattersonart.com

3. Review Your Data

Collecting data is great, but the real reason you do that is to learn something from it. Lucky for us, apps such as Mint will do all the all the heavy lifting. As long as you are keeping your accounts connected and the expenses categorized, trends and variances will appear. Quickly you’ll realize that you spend a surprisingly large amount on lunch outings, that Pokémon Go isn’t really free, and that going to the bar is really expensive. With Mint, you can see your average monthly spending for a variety of categories and the software will suggest setting a budget equal to the average (and you can adjust from there). If you have connected your bank accounts, Mint will pull in your after-tax income and compare it to your expenses, giving you a quick idea of whether you are living within your means. If you determine that your spending is higher than your income, you will now be able to examine your spending in detail and decide which costs have to go.

There is nothing wrong with spending the money that you worked hard to earn. Going out to eat, traveling, or spending time at a restaurant with friends are all activities that contribute to a life worth living. What you do with your spending information is up to you, but the important thing is to have the data so that you can make informed decisions, live within your means, and make changes when necessary.

4. Monitor and Set Up Alerts

Earlier this year, my wife and I decided to take a trip down to her favorite U.S. city: Savanah, Georgia. We found a few places on VBRO that interested us and decided to book one that had the perfect location and was reasonably priced. Once we received the confirmation, we noticed the price was much higher than expected due to cleaning and booking fees. We immediately contacted the owner to cancel and they happily obliged. Good thing we looked at the receipt, right? We booked another place, took our perfect trip to Savannah, and lived happily ever after.

Well technically this is true, but the story wasn’t over. A week later during my normal review of Mint, I noticed we still had not been refunded for the apartment. Yes, the person did cancel our request, but they failed to reverse the transaction. It took another few emails and follow-up, but we eventually got the situation resolved. I tell this story because it is an all-too-common occurrence, no matter the size of the organization or the type of transaction. Mistakes are made, and basic monitoring of our accounts can save us hundreds of dollars.

Mint has a lot of helpful built-in notifications to assist with monitoring your accounts. You can receive alerts to remind you of upcoming bills, notify you when you are charged a fee, or gently let you know when you have exceeded a set spending amount for a particular expense category. I urge you to be careful with the alerts. Many people learn to dread receiving the “helpful” emails from Mint because they know opening it will make it hard to ignore the high spending on Starbucks or golf. Don’t let this happen to you. Find your strictness sweet spot: helpful enough to provide the information you need to make informed decisions, but not so much that it’s annoying. For example, I consistently review my expense category budgets on my own and therefore turned those alerts off, but I still like getting alerts for an unexpected finance charge or late fee.

Conclusion

This article just barely scratched the surface of budgeting or the power of financial apps. Over time you can continue to build your financial foundation and learn different techniques, but start with this advice: Do not run from your spending habits, embrace them and understand them. Knowing your data can allow you to make informed decisions. If you love going out to eat, great. Maybe you could be doing it more! You’ll never know what opportunities you are missing or sacrifices you are unknowingly making unless you quantify your spending habits. Could you drive a mile down the road and save $60?

Are you interested in getting one-on-one personalized advice on budgeting and spending? Click here to schedule a FREE 30 minute call with David, a Certified Financial Planner (CFP®) professional and Certified Public Accountant (CPA), and get answers to all of your money questions.