Employer-sponsored retirement plans (ESRPs) are offered by many employers as a benefit to assist their employees with saving for retirement. Through participation, employees receive an automated savings program with easy enrollment and lower fees for being part of a larger group. Employers also benefit by offering retirement plans not only by attracting and retaining talent, but also because these plans generally contain a tax-deductible component.

ESRPs come in a few different flavors, the most common being:

- Thrift Savings Plans

- 401(k)s

- 403(b)s

- 457(b)s

1. The Power Of Compounding

Have you ever heard the phrase “make your money work for you”? What this phrase refers to is financial compounding. It is one of the most important keys to wealth creation, and it could not be any easier to take advantage of.

Step 1: Take your money out from under your mattress or checking account (same thing).

Step 2: Deposit it into a savings account.

Step 3: Watch your money grow.

Step 4: There is no step four. Seriously, that’s it.

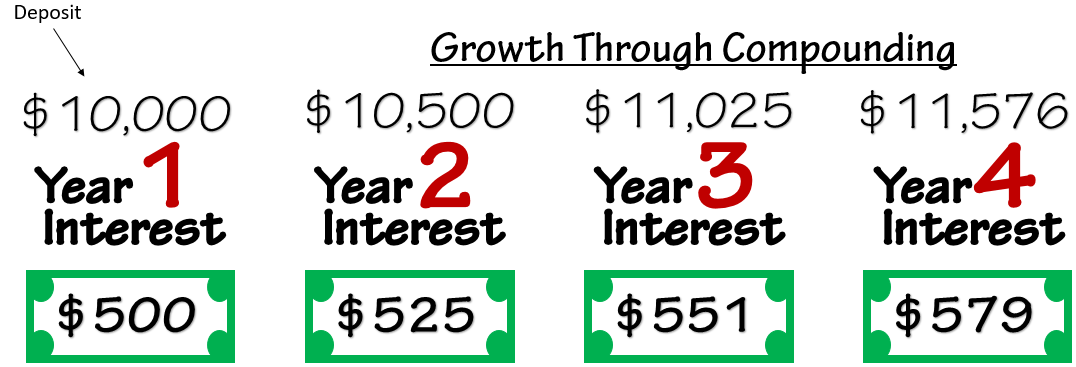

Growth Through Compounding

When money is held in a savings account, interest is paid based on the interest rate and the account balance (which includes interest paid in prior periods). This means that each month the interest payment gets bigger and bigger, little by little, as it is calculated on a growing balance in the account. Over time, that once-small amount can become a substantial sum of money as the power of compounding builds upon itself. What most people don’t realize is just how substantial the growth can be! Check out the following example where you deposit $10,000 in an account yielding 5% per year for 4 years.

The interest payment in the first year is $500 ($10,000 × 5%), but by the second year it has already grown by $25 to $525 ($10,500 × 5%). This growth continues compounding year after year, producing larger and larger interest payments. Now that is making your money work for you!

Ten years ago it was possible to find a savings account yielding 5%. Now? No way. My Bank of America saving account is yielding basically nothing, 0.03%. (Yep, those zeros are in the correct location. The interest rate is 3/100 of one percent or 3 cents on a $100 deposit.) But don’t be discouraged… do you know where you might be able to get a 5% return? In your retirement plan! Through your plan, you can invest in a combination of stocks and bonds where the same principles of compounding hold true.

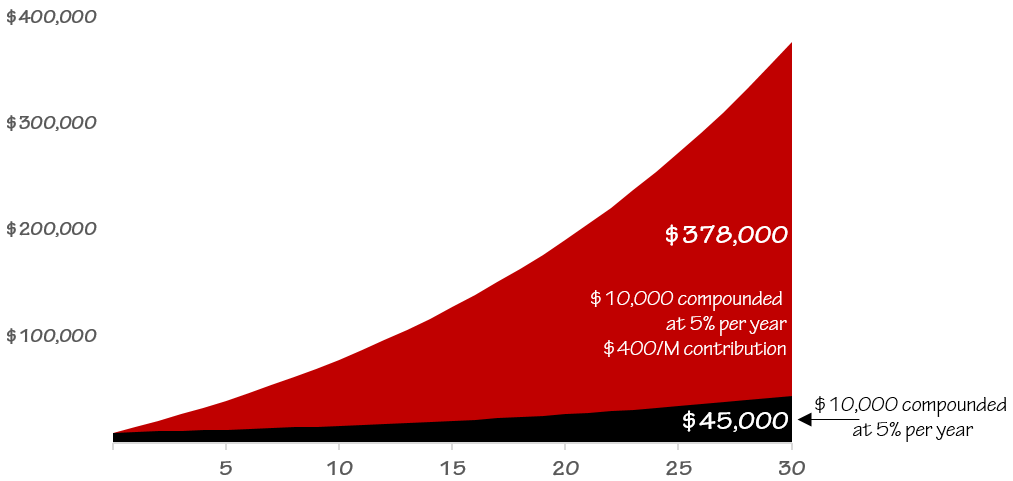

Growth Through Compounding & Continuous Investment

The scenario above was a simplified example that showed the power of growth through compounding. In the real world, we usually make continuous contributions to retirement plans through regular paycheck deductions. Continuous investment, along with the power of compounding makes for even greater wealth creation. More contributions… more compounding… more money.

In the first scenario, if we left our initial deposit of $10,000 in an account yielding 5% for 30 years, it would grow to be about $45,000—no small feat! But if we had made continuous contributions to the account, as we do with retirement plans, of say $400 a month, the difference would be substantial. An initial $10,000 with a monthly contribution of $400 and an annual growth rate of 5% would grow to be more than $378,000.

By starting with $10,000 and contributing $400 a month for 30 years, we contributed a total of $154,000. However, our contributions more than doubled over that period to $378,000 through the power of compounding.

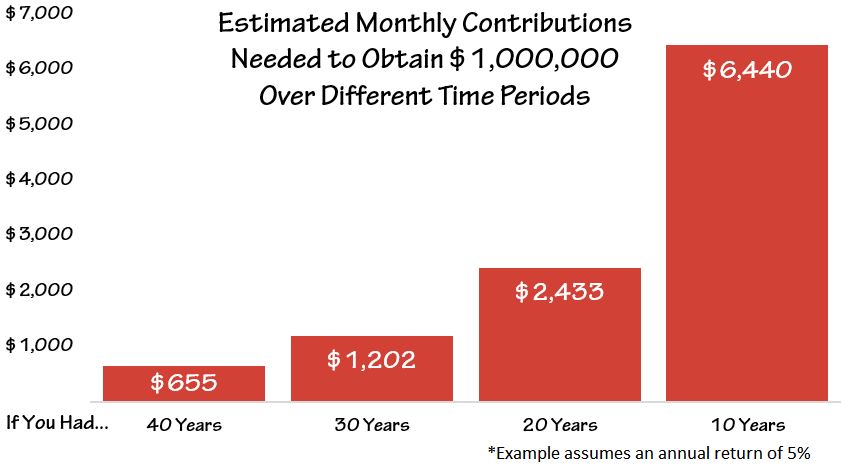

Who Wants to be a Millionaire?

When it comes to compounding, time is your best friend. If you are able to start saving for retirement early, your money will have longer to compound and will grow larger, faster. I honestly believe everyone can become a millionaire—even without the help of Regis Philbin—as long as you have the power of compounding and plenty of time.

Someone with a 40-year time horizon may be able to use the power of compounding to become a millionaire by contributing $655 a month to their retirement plan. That may sound like a lot of money, but it’s total contributions, including yours and any match from your employer (teaser: the employer match is reason #4 for contributing to retirement plans). If your employer matches 100% of your contributions you’d only have to contribute a little over $325 a month to become a millionaire by retirement. Compare that to someone that doesn’t start saving until 10 years before retirement—they need to contribute $6,440 a month (including any employer match).

2. Tax Advantages

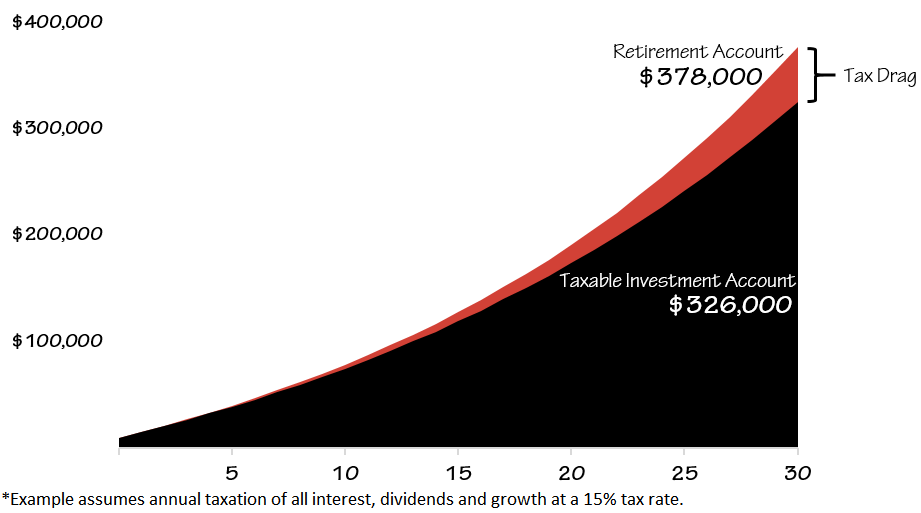

Great, so there is a compounding effect, but that’s available in any investment or savings account. Why don’t I just save into one of those? Although there are a few reasons, one of the best may be the tax-advantaged status of retirement plans. Specifically, the annual growth is not taxed as it is in a normal investment or savings account—it’s excluded. This allows your investment to compound on a larger number and experience greater growth.

Tax Advantages of Retirement Plans – No Tax Drag

In a taxable investment or savings account (but not a retirement account), you must pay tax each year on interest, dividends, and recognized capital gains. This is commonly referred to as tax drag, and it can really eat into your investment performance. This happens because part of the money earned on your investment must be paid to meet your annual tax liability, and the balance for compounding is that much smaller the next year. In the following example, look at how the tax drag would impact our scenario of an investment of $10,000 with monthly contributions of $400 and a 5% return.

In the scenario above, the tax drag in the investment account reduced the ending portfolio value by $52,000 (just under 14%) over 30 years compared to the retirement account! This makes a significant difference when it comes to your retirement savings, simply by choosing the right account (i.e., a retirement account).

Tax Advantages of Retirement Plans – Deductible Contributions

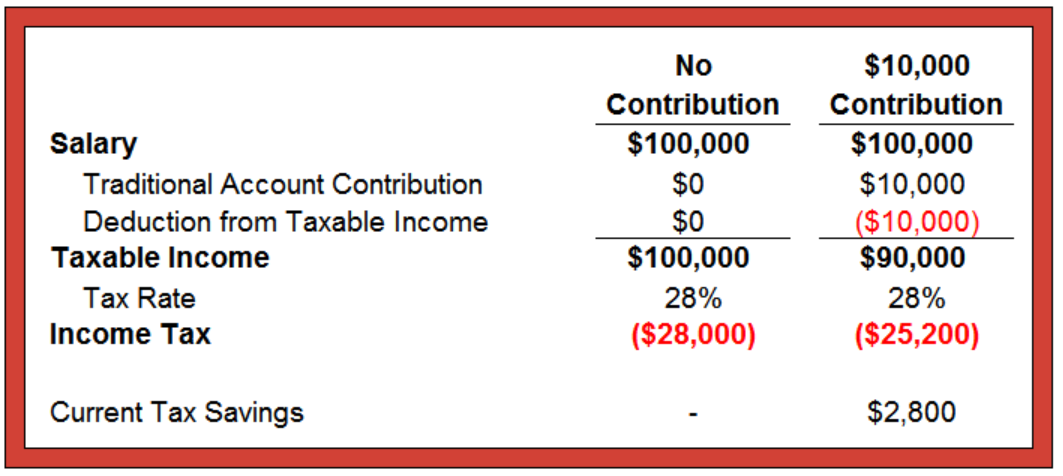

A second tax advantage that retirement plans have over other account types is that your contributions may be tax-deductible. In other words, if you make contributions to a Traditional retirement plan (as opposed to a Roth account), that amount is subtracted from your annual income for the computation of income taxes, reducing your liability. This can put more money into your pocket and act as an incentive to save. Let’s run through an overly simplified example.

Let’s say your annual salary is $100,000. If you contribute $10,000 (10% of your salary) to your Traditional 401(k), your taxable income will be reduced to $90,000. (That is the amount the federal, and possibly state, government will use to calculate your tax.) Ignoring deductions, if you are taxed at a 28% rate, every dollar you contribute will save you 28 cents in current taxes. That would work out to be $2,800 less in federal taxes simply by contributing to your retirement plan! If you are also subject to state taxes, then your savings could be even higher.

3. Your Employer May Pay You To Do It

Who doesn’t like free money? This is obviously a rhetorical question, but a lot of people are answering “I don’t!” when they fail to take full advantage of matching employer contributions to retirement plans. Employer contributions come in all sizes. Perhaps yours matches 50% of your contribution up to 4% of your salary. That means if you make 50,000 and contribute $4,000 to the account annually, then your employer would add another $2,000—not bad!

It could be any combination of percentages and caps. Some are more common than others, but employers have a lot of discretion when setting up retirement plans. Employer matches on personal contributions to retirement plans are a great incentive because they are an easy way to increase your compensation (even if you can’t use the funds for many years). When you begin a job, it is important to know exactly how the match works and what amount you need to contribute to take full advantage. Don’t lose out on free money!

4. Protection From Creditors

Employer-sponsored retirement plans receive special protections under the Employee Retirement Income Security Act of 1974 and the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. These laws attribute a special status upon funds contributed to ESRPs, adding an additional layer of defense from creditors in the event of bankruptcy or a civil suit. This is not the case with your savings accounts, taxable investments, or possibly your individual retirement accounts (IRAs). If you were to be sued or file for bankruptcy, creditors would have the right to seek payment from you by draining your bank accounts. However, by having your savings held in employer-sponsored retirement plans, creditors will have more difficulty gaining access to the funds. You may believe that you are at a very low risk of being sued and even further from claiming bankruptcy, but unforeseen things happen and extra protection is not a bad idea. Having the proper insurance is one line of defense you should implement, and having your money in the proper account is another.

5. Protection From Yourself

Saving into retirement plans is a long-term decision. If you don’t leave your money in your retirement plan, all of the other benefits are thrown out the door! Although it is possible to take an early distribution, it is only allowed in certain circumstances without being subject to a 10% penalty. This may be one of the greatest advantages of retirement plans because it forces you to benefit from the magical effects of compounding. If you begin making contributions right after college at the age 21 and don’t touch the money until you’re 70, you’ll benefit from close to 50 years of compounding and growth!

If your retirement savings were held in a normal investment account you may be tempted to take a few dollars out for a trip to South America or to purchase a car. However, by setting aside the funds such that accessing them comes with a penalty, you may think twice.

Always Remember: It Depends!

Finance is a very personal subject, and the best choice for you depends on many factors. Although the above advantages do apply to most employer-sponsored retirement plans, each individual’s situation is unique and making contributions to a retirement account may not be in everyone’s best interest at all times. For example, if you have large amounts of credit card or student loan debt, depending on the amount and the interest rate, paying down that debt may take precedence over saving for retirement. Consult with your financial planner to determine what may be the best course of action for you.

Are you interested in getting one-on-one personalized advice on retirement planning? Click here to schedule a FREE 30 minute call with David, a Certified Financial Planner (CFP®) professional and Certified Public Accountant (CPA), and get answers to all of your money questions.