Planning an overseas vacation can be a lot of fun, but is also a lot of hard work. As we book flights, plan our activities, and decide between a million options for accommodations, we must remain mindful of the mounting costs and try to stay within our budget. Throughout all this planning there’s often one factor we overlook that can be a significant contributor to the overall cost of our vacation—how we spend! I’m not talking about how much we spend on food and activities while traveling, I mean the actual way in which we fork over our dollars (e.g., traveler’s checks, currency exchanges, ATMs, credit cards). How we choose to use these different payment methods can significantly increase the cost of our vacation by 5% to 15%.

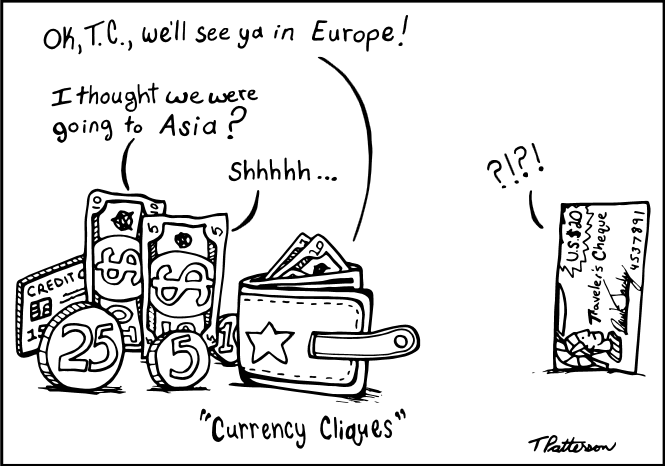

1. Forget Traveler’s Checks

Traveler’s checks have a long history. They were first issued in the late 1700’s by a London-based company to make European travel safer for its customers by reducing the need to carry large amounts of cash while traveling. Each check represents a predetermined amount of currency, can only be cashed by the original purchaser (with signature and photo ID), and comes with a guarantee of reimbursement in the event it is lost or stolen. In the 1890s, American Express began offering traveler’s checks to Americans wanting to travel abroad. Until the late 1990’s and early 2000s, traveler’s checks were the dominant form of payment for international travelers because they were widely accepted and provided safety.

The first time I went to Europe was in the summer of 2008, as part of a two-week study abroad trip to Ireland and England. In preparation for my adventure, I went to the bank and requested several hundred dollars in traveler’s checks. When I arrived, I had all of these super secure checks, so I didn’t have to worry about holding large amounts of cash. My understanding was that everyone would happily accept them by allowing me to pay the amount that I owed and providing me with the remaining amount of each check in local currency. The problem was it was 2008, not 1988! No one, not one merchant, wanted to accept my checks. I quickly learned that if I wanted to cash my checks I would need to find a bank, stand in line, and hope that they would accept my oversized Monopoly money. Being that I was with a large group of college kids running around from one thing to the next, the last thing I wanted to do was stand in line and miss all the fun. Ain’t nobody got time for that!

American Express’ website touts the benefits of traveler’s checks as secure currency that will help you budget your spending throughout your trip. Well, I agree. Traveler’s checks are extremely secure! So secure that you won’t even be able to cash them. I also had no problem sticking to my budget once I found out I literally couldn’t spend money. Do yourself a favor and leave the traveler’s checks at home with your Tamagotchi and pager.

tpattersonart.com

tpattersonart.com

2. Take Destination Currency with You for Incidentals

Regardless of where you’re going and what you plan on doing when you get there, I highly suggest that you take at least some cash with you for incidentals (e.g., cabs, airport snacks), in the currency that you’ll be spending. Most major financial institutions will procure whatever currency you need with a few days’ notice, and exchange it for dollars at the current exchange rate. Last time I travelled, I was able to order currency from Bank of America in just a few minutes online. Once logged into my account, I searched for foreign currency and landed on an easy form to complete. I selected the country, the amount, the denominations, and whether I wanted the funds sent to my house or made available at a branch for pick up. They even provided a nifty exchange rate cheat sheet to help me know how much I was spending in foreign currency. (Get your own! This one is now outdated.) On first glance, it appeared as if I was not being charged any fee for this amazing service. However, once I looked closer I realized that their fee is hidden in the exchange rate.

At the time I am writing this article, the current exchange rate for Brazilian Reals to U.S. Dollars according to Google Finance is $0.31 per Real. As you can see in the exchange rate chart above, Bank of America is quoting me $0.34 per Real, $0.03 higher than the market rate. Three pennies may not sound significant, but it is almost a 10% premium! Translate that out across a large purchase of currency and it can have a huge impact by raising the cost of your vacation by 10%. Your bank may have a more reasonable exchange rate or possibly charge a flat fee for currency conversion, but the important thing to recognize is that the fee could be hidden in the exchange rate. Before choosing a provider of foreign currency, do a quick Google for the market rate by searching “USD to {your destination currency}” so you know what you’re getting. If you’re unable to obtain the market rate, I recommend exercising healthy skepticism with bank employees when receiving quotes. In my experience, many of them are unaware of the hidden fees. Due to this significant premium on exchanging currencies, I suggest only obtaining enough for incidentals while you are still in the U.S. The rest of the cash you need should be obtained at an ATM upon arrival (read on for advice on how to do that) – avoiding exchanges in airports and other touristy locations.

Although it may seem like overkill, it’s also a good idea to check in on your destination country’s major news stories for a few weeks before leaving. For our honeymoon, my wife and I went sailing in the Greek Islands. We arrived in Athens on June 25, 2015, to a country in the midst of financial crisis. In order to slow the flow of currency out of the country, the government mandated that all banks be closed and citizens only be allowed limited ATM withdrawals. Riding into the city from the airport we saw large groups of people crowded outside of every bank. At first we thought they were protestors, but quickly realized the people were all in line for the ATM. Although tourists were not subject to the daily maximum withdraw limit, many ATMs were routinely running out of cash each morning. Fortunately, we had been following the news and decided to take a larger amount of Euros in spite of the premium involved to ensure we would have currency available.

3. Withdraw Currency From an ATM as Needed

One of the best options for people that are traveling or living abroad is to simply withdraw cash from foreign ATMs as needed. This is safer than withdrawing and carrying large amounts at a time, and it can also help you budget your money while you are traveling. If you only withdraw what you need on a periodic basis you do not run the risk of having all of your vacation funds stolen or spending it all on a wild night. ATMs are so widely available in today’s world that there is rarely a time when there is not one within a few blocks. Of course, if you are traveling somewhere remote or less developed you may need to plan ahead and make sure you withdraw enough funds at the airport ATM (not an airport currency exchange) or another more connected area when you have the chance.

As with ATMs in the U.S., the fees for withdrawing funds will vary based on the machine you use and on which network it operates. Different banks treat foreign ATM withdrawals differently, and some will charge multiple fees. On top of standard non-home-bank fees (by your bank and the bank you are withdrawing from), you may also be charged a flat foreign withdrawal fee and/or a percentage of the amount withdrawn. Check your bank’s website or contact a representative to find out which fees apply to you before making a withdrawal. It may even make sense for you to change banks if you are traveling frequently or living abroad because some banks offer accounts that are not subject to foreign withdraw fees. To see how your bank measures up, check out Nerd Wallet’s summary.

Before your bank cards will function in a foreign country, most financial institutions require that you notify them of your travel plans. This is to protect your account from theft and fraud. As the world has become more global, notifying your card provider about upcoming travel has become easier. Most allow you to provide the notification online.

4. Use a Credit Card Whenever Possible

I personally hate carrying cash when I’m abroad. I spend it too easily, I don’t want to keep track of it, and it always morphs into a pile of clunky coins. Instead, I use a credit card whenever possible. Credit cards are widely accepted, and thanks to the introduction of chips in American credit cards, they are now very easy to use abroad. A credit card is the safest and cheapest way to spend money abroad because it functions just like it would if you were using a credit card in the U.S., in that there is little risk of losing your money because you are rarely responsible for fraudulent charges.

Most credit cards, like debit cards, do carry a foreign transaction fee. However, applying for a card that has zero foreign transaction fees is relatively easy (Capital One, for example, is known for offering multiple cards). When I use my Capital One card abroad, the merchants receive payment in their currency, and it hits my statement in dollars at the current exchange rate with no fees at all. It’s easy, safe, and I receive rewards points for all my spending. Discover and American Express also offer cards with no foreign transaction fees but they are not as widely accepted as Visa and Master Card.

Credit cards are definitely the best option given they are safe, available with zero fees, and offer cash-back benefits. If you plan on traveling and don’t already have a card with no foreign transaction fees, check out some that Nerd Wallet reviewed.

Diversify Your Currency Options

A combination of all of the above is really your best course of action, because you can always run into trouble. To recap, my final tips for spending abroad are:

- Order some currency from your bank ahead of time for incidentals.

- Always notify your card providers of your upcoming travel.

- Write down the international numbers to call your financial institutions in case of an emergency.

- Use a credit card with no foreign transaction fees whenever possible.

- Pack a back-up credit card with no foreign transaction fees in case you lose your primary card.

- You can also consider adding your spouse or travel buddy as an authorized user of your cards, and keep one in your wallet and the other in safe place.

- Use a debit card with no foreign transaction fees whenever possible.

- If you have more than one debit card, consider bringing a second in case you lose your primary card.

- Choose cards from different payment networks (e.g., Visa, Mastercard, Amex) in case your primary card isn’t accepted.

Are you interested in getting one-on-one personalized advice on making smart financial decisions while living or traveling abroad? Click here to schedule a FREE 30 minute call with David, a Certified Financial Planner (CFP®) professional and Certified Public Accountant (CPA), and get answers to all of your money questions.