I love the term double-edged sword. It is an amazing visual representation of risk and reward. Something that is beneficial, that can even protect you, but can be used against you without the appropriate precautions.

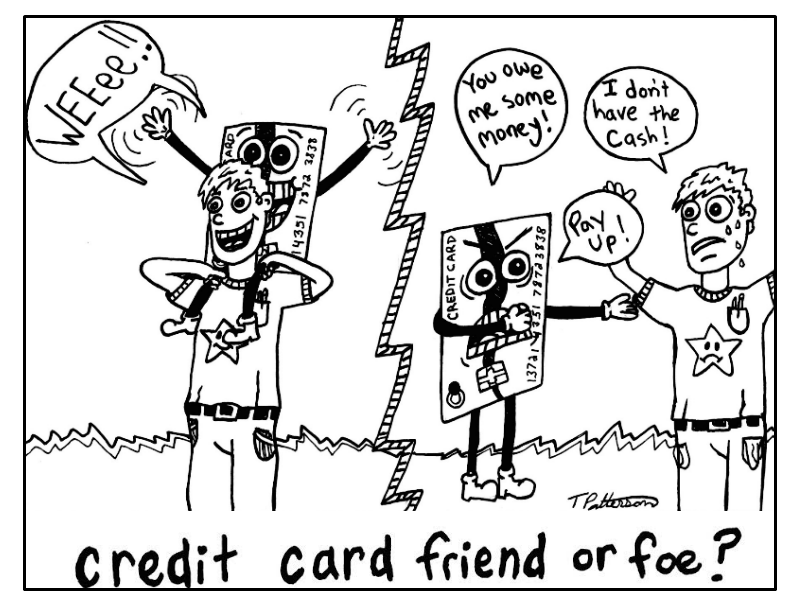

Credit cards are a financial double-edged sword. Their benefits are obvious, such as being easy to use, building your credit, and providing rewards points. But, they’re also extremely dangerous because they can lead to overspending, interest expenses, fees, and debt. Without taking the necessary precautions, credit cards can lead to financial ruin. That’s why I’ve created a rule book for you to follow to shield yourself from the danger of credit cards.

tpattersonart.com

tpattersonart.com

The Rules for Using Credit Cards Wisely

1. No Budget, No Credit Cards

Remember my post 4 Steps to Have Power over Your Spending? “When it comes to achieving financial success, I have some exciting news for you: Size [of your income] doesn’t matter!”

It’s true! To be successful you must save and live within your means. The problem with credit cards is they make it insanely easy to do the opposite. They separate the feeling of paying for something and obtaining it. While this separation can make you feel financially free, it’s also very dangerous.

Credit cards are meant to increase the speed, safety, and efficiency of payments within your current lifestyle, not inflate it. They must be used in conjunction with a budget to ensure you always have more money coming in than going out. That’s the only sustainable way to live.

2. Always Pay the Balance in Full

There is zero benefit to carrying a balance, it doesn’t help your credit score and, in fact, it can be extremely costly. You will likely incur interest rates in excess of 15%. That’s basically like increasing the price 15% on everything you buy!

Rule #1 and #2 go hand in hand. If you stick to your budget when using a credit card, you should always be able to pay the balance in full. I get it, unanticipated, mandatory expenses pop up. However, this should be covered by an adequately funded emergency savings account. With proper planning there should never be a reason to carry a credit card balance from month to month.

3. Set Up Auto Payment

Credit card companies make money when you miss a payment. I picture them waiting by the mailbox as the due date approaches… hoping and wishing that your check doesn’t arrive. Then BAM! One day late and they hit you with late fees and interest expenses.

Automatic payments are easy to set up, and usually only need to be done once. They save you from the risk of missing a payment and remove the stress of remembering dates. I’ve heard two main arguments against using automatic payments, but they’re flimsy.

The most common: “What if there’s a mistake on my statement?” If you have power over your spending this shouldn’t be a concern. You’ll be looking at your spending weekly, if not more often! Allowing you to catch errors in real-time. When the statement arrives, you’ll have confidence to pay the bill automatically. (See rule #5 for more.)

The second reason: “I need to make sure there’s enough money in my account.” No one wants to get hit with overdraft fees. But the question is—why wouldn’t there always be sufficient funds? Your income should be automatically deposited into the same checking account that pays your credit card bill. As long as you are living within your means there should always be adequate funds to pay the balance.

4. Keep a List of Auto Payments

One day I had a long discussion with a coworker about the merits of using credit cards. He was completely against them. I was shocked because of his strong financial background. He knows both the merits and risks of credit cards. Eventually, I got to the root of his issue—he moved, didn’t update his address, and missed a payment. He didn’t just miss it once, we’re talking multiple years! The balance, interest, and fees all grew without his knowledge. He didn’t notice the outstanding balance until he went to buy a new house and they pulled his credit.

Don’t be like my coworker! (Also monitor your credit! More on that in a future post.) Things in life change, including your address and bank account numbers. When they change, you may need to update your auto payments. The easiest way to do this is to keep a list. When you move or change accounts you can reference the list, allowing you to quickly see which payments need to be updated.

5. Review Your Spending in Real-Time

Statements are outdated as soon as they arrive (no matter if it’s digital or paper). They contain spending from last month and it’s already the middle of this month! Do you remember what you purchased 45 days ago?

Avoid the hassle and use expense tracking technology (like Mint) to monitor your spending in real-time. This will allow you to catch errors on your statement and have confidence that when your bill is paid automatically, it’s correct.

6. Always Use Your Credit Card

Ok, not always. There are certain expenses (such as utilities, rent, and mortgage payments) that may not allow you to use a credit card or may charge you a fee for doing so. Generally, if there’s a fee, use a check or debit card instead.

But you want to use a credit card for everything possible because you’ll get more rewards and build your credit faster. Credit cards are wonderful because you get paid for making everyday purchases. Choosing to use cash or debit is like missing out on free money or paying more than you have to.

7. Pick Up the Phone

Stuff happens. I try to live by the rules in this blog, but life can get in the way and sometimes even I get hit with a finance charge. Fortunately, all of my accounts are connected to Mint. So when it does happen, I get an email right away, and I can check into what happened.

What should you do if you get hit with a credit card finance charge? Pick up the phone! Most companies will work with you. Speaking politely with a slight sense of urgency and an apologetic tone can go a long way. If you call and make a payment quickly after the due date, chances are the representative can reverse the charge. This can save you a couple of bucks and keep that red mark off your credit score. There is no reason not to give it a try.

8. Report Your Lost or Stolen Cards Immediately

One of the greatest credit card benefits (besides the free rewards) is security. Federal law limits liability for unauthorized transactions to $50. This means you don’t have to sweat if you lose your card… but you still shouldn’t waste time before reporting it missing. The more fraudulent charges, the longer it could take to clean up. This could cause short-term cash flow and credit score issues.

9. Always Leave a Tip

No, I don’t mean you have to tip your dry cleaner or Starbucks barista (unless you want to). I mean always put something on the tip line. Receipts often have tip lines, even when etiquette doesn’t call for gratuity. Protect yourself from someone filling in a tip post signature by writing something yourself. A zero, a dash, your Snapchat username, whatever—just don’t leave it blank.

Furthermore, fill in the total too. Leaving that section empty is like signing a blank check. Your card issuer is likely to accept the amount submitted by the merchant and hold you accountable. Think about it, the merchant has a signed document. Your copy of the receipt is blank and sitting in a landfill in New Jersey. Who are they going to believe?

10. Opt for No Annual Fees

There’s an ocean of credit card choices that fill your mailbox every week. We are bombarded with credit card offers, and having good credit gives us the pick of the litter. The multitude of selection means there is no reason to pay an annual fee. Yes, there are some really great cards with annual fees, many of which may have amazing rewards that justify the fee. However, for the vast majority of us, a simple, no-fee card is the way to go.

11. Cut Up Your Cards

There are two reasons to cut up your credit cards:

Outdated: Don’t keep old cards. If your card is replaced, canceled, or expired, cut it up and throw it away. If you want to be extra secure (paranoid?), put the pieces in multiple trash cans. This should ensure that no one can use them for fraudulent purposes.

Neglect of Rules 1-10: If you can’t follow rules 1 through 10, then #11 is all you need. We have all seen credit card interventions on TV. John has a spending problem. So, his concerned friend takes his credit cards and cuts them up into a million pieces. John jumps up and down yelling. Lays against the counter trying to put the puzzle pieces back together. Then slips down to the floor, curls into a ball and cries.

Look, sometimes that’s necessary! And, I hope you are strong enough to do this or have a friend that’s willing to do it for you.

Conclusion

Credit cards are an amazing tool. They’re convenient, safe, help us build credit, and reward us for our spending. However, they are a double-edged sword and can be a dangerous liability to our financial health if not used properly. If you want to experience the benefits of credit cards while protecting yourself from the dangers, you must be intentional and follow the rules. If you don’t, you (and your cards) might get cut!

Are you interested in getting one-on-one personalized advice on how credit cards fit into your financial life? Click here to schedule a FREE 30 minute call with David, a Certified Financial Planner (CFP®) professional and Certified Public Accountant (CPA), and get answers to all of your money questions.